Electricity Consumptions - Exemptions for Specific Domestic consumers

Section 235. Electricity Consumptions - Exemptions for Specific Domestic consumers

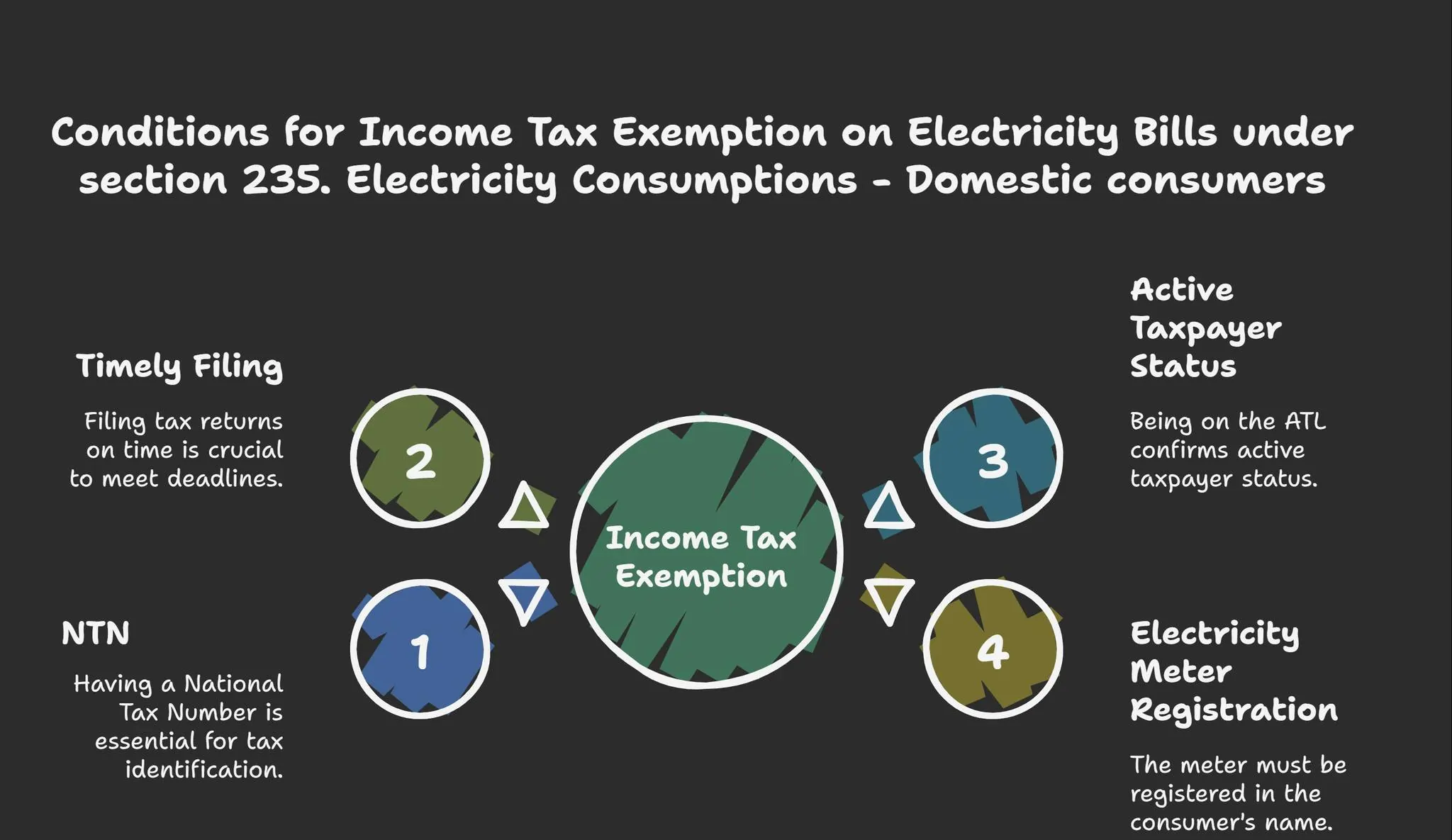

Are you a domestic electricity consumer and also a registered taxpayer? Great news! You might be exempt from income tax on your electricity bill under Section 235 of the Income Tax Ordinance, 2001 — but only if you meet the following conditions:

You are not liable to pay income tax on your electricity bill if all of these apply:

- You have an NTN (National Tax Number).

- You file your income tax return within the due date.

- Your name appears on the Federal Board of Revenue's Active Taxpayer List (ATL).

- The electricity meter is registered in your name.

Leave a Comment