Heads of Income Pakistan

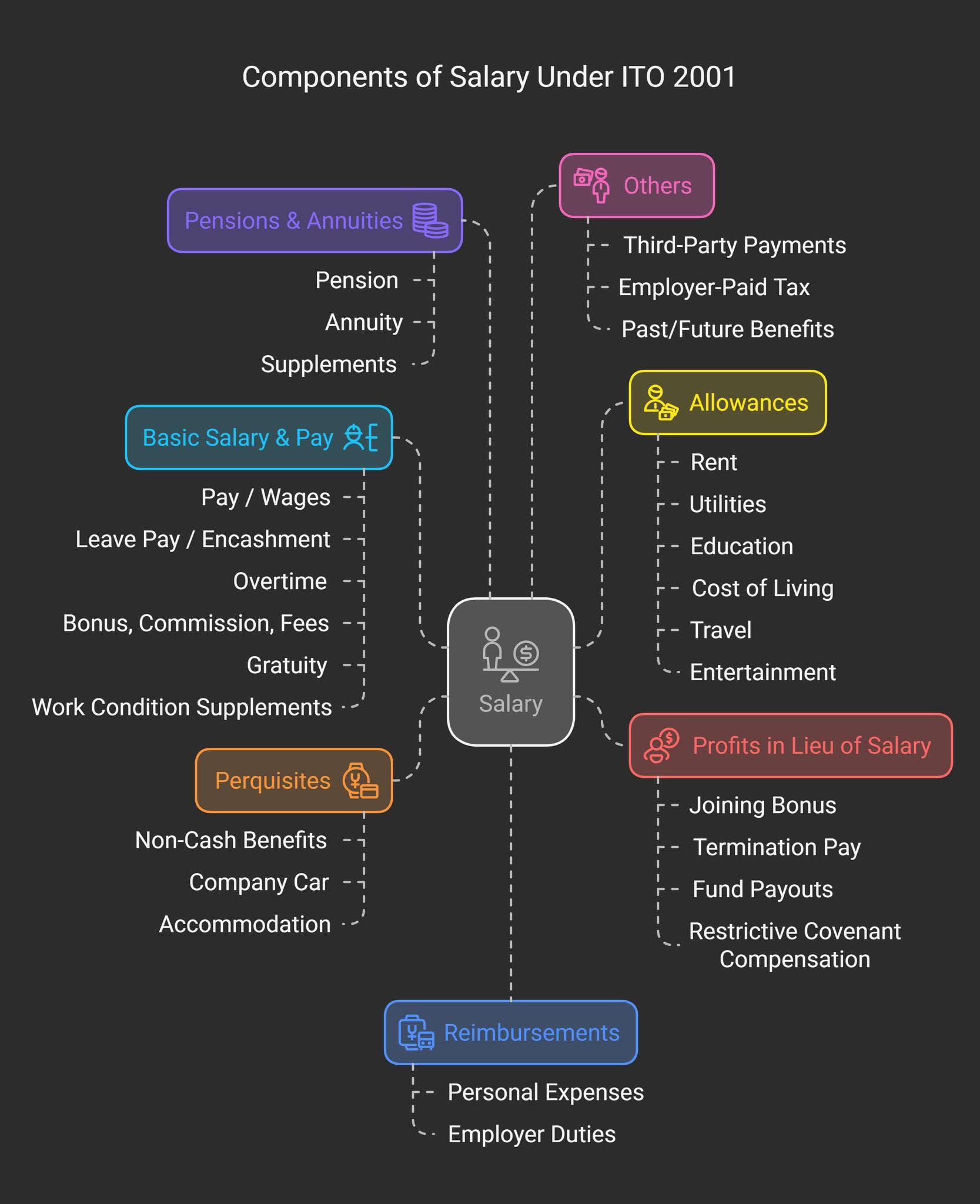

1. Income from Salary

Income received by an individual from an employer under an employer–employee relationship.

Includes:

-

Basic salary

-

Allowances (house rent, medical, conveyance, etc.)

-

Bonuses and commissions

-

Perquisites (company car, accommodation, utilities)

2. Income from Property

Income earned from renting out immovable property.

Includes:

-

Rent from houses, flats, shops, or commercial buildings

-

Advance rent

-

Forfeited security related to lease

3. Income from Business

Income derived from trade, profession, or commercial activities.

Includes:

-

Business profits (sole proprietorship or partnership)

-

Professional income (doctors, lawyers, consultants, freelancers)

-

Manufacturing, trading, or service income

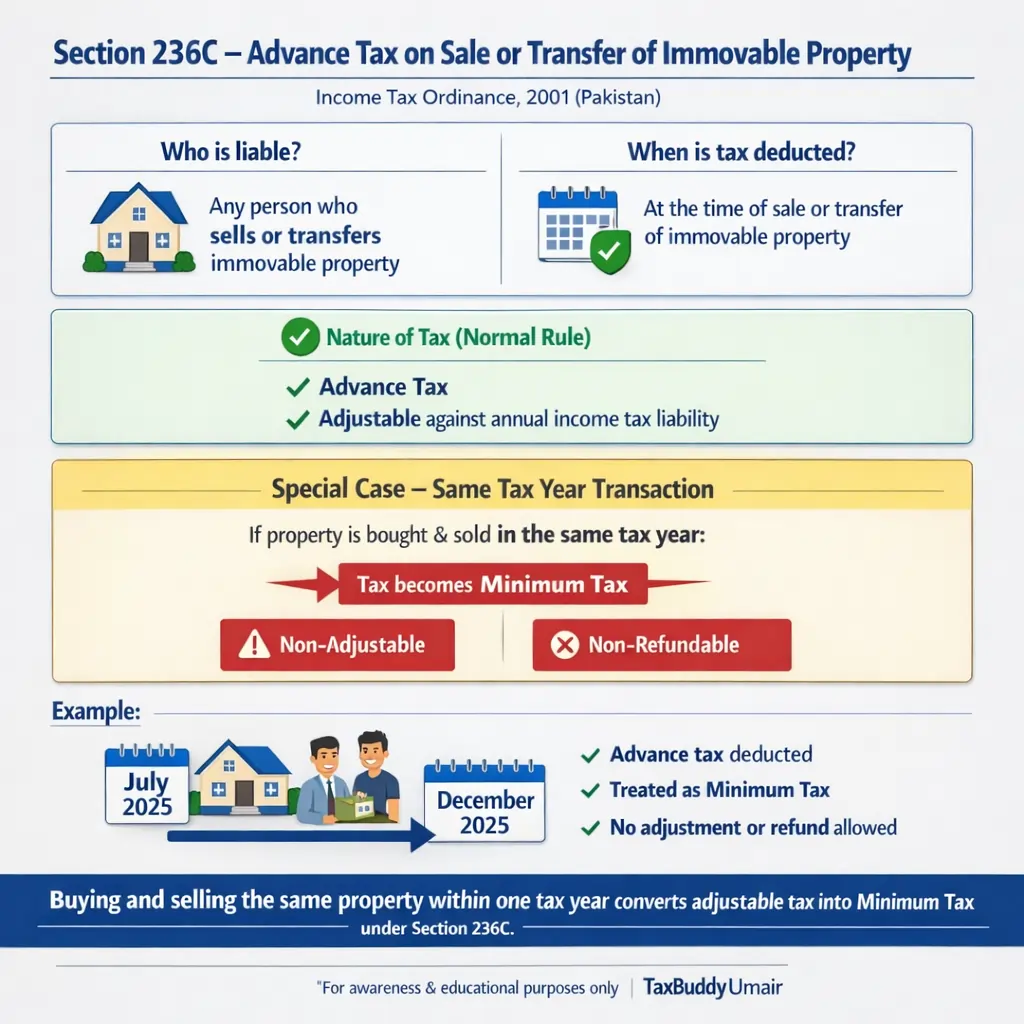

4. Capital Gains

Profit arising from the sale of immovable property (plot, house, or building).

Tax depends on:

-

Holding period

-

Type of property

-

FBR-notified fair market value

-

Applicable exemptions (if any)

5. Income from Other Sources

Income not covered under any other head.

Includes:

-

Dividends

-

Prize bonds or lottery winnings

-

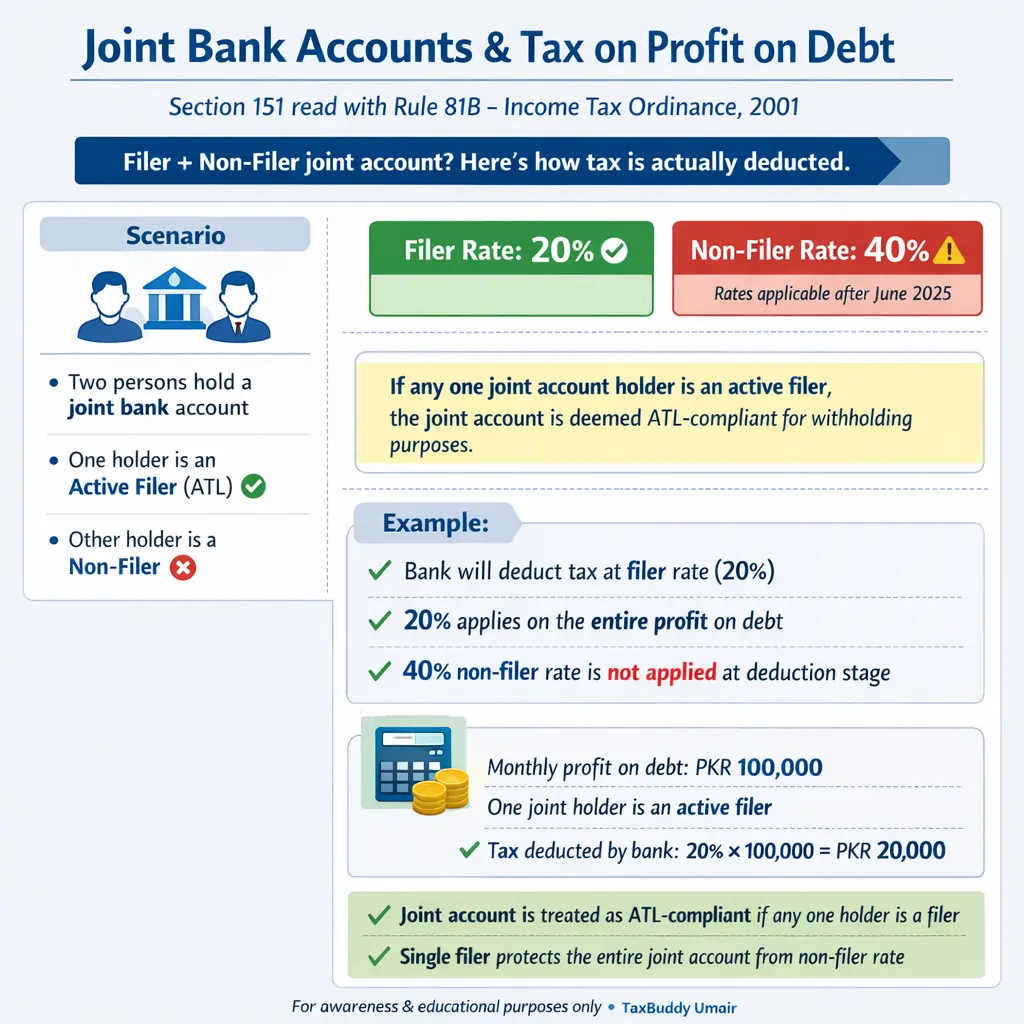

Bank profit / interest

-

Profit on debt

-

Royalty or technical service fees