Important Update: SRO 350(I)-2024

Important Update: SRO 350(I)/2024 – Issued on March 7, 2024

This notification addresses the following three key areas:

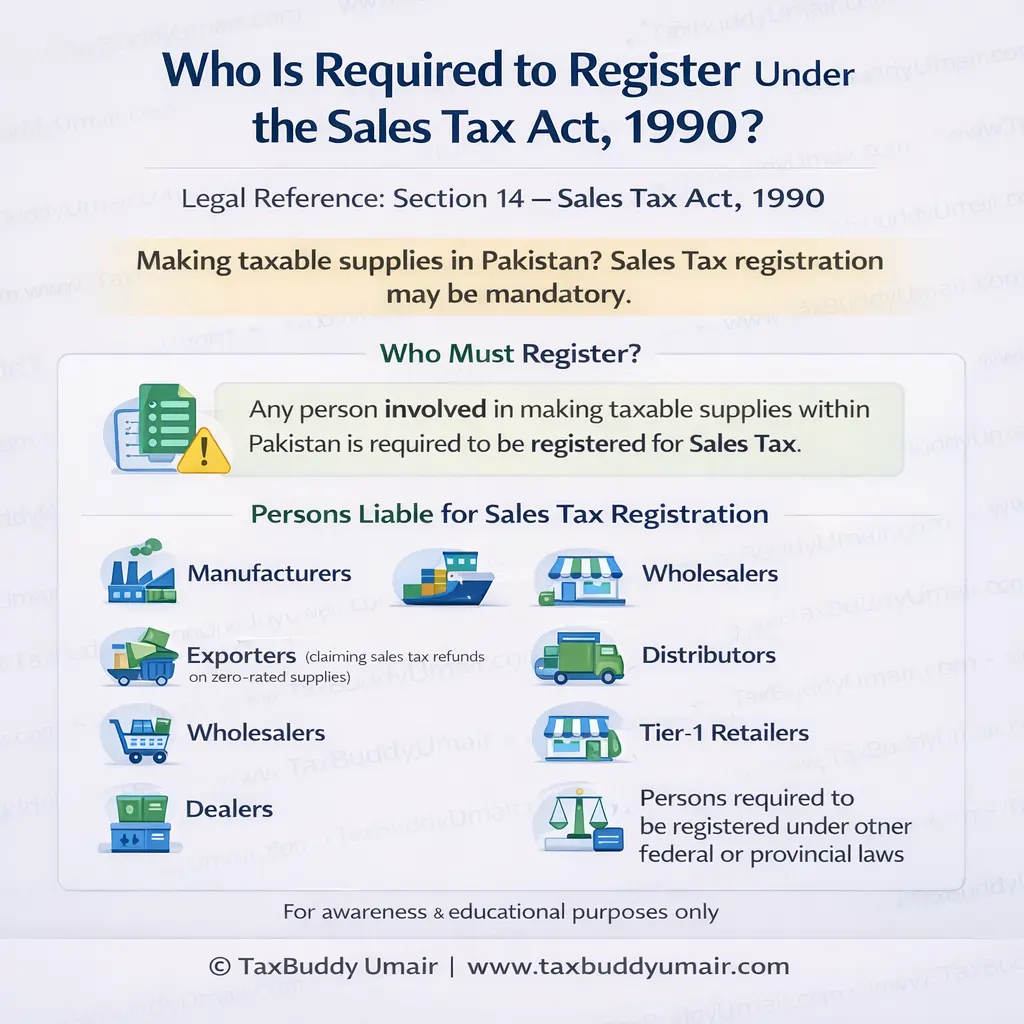

1. Registration

2. Sales

3. Input Tax Adjustment

Target Registered Persons are :

- Individuals

- AOP

- Single Member Company

Note : Manufacturers are not included in the said SRO

Registration :

- Taxpayers must submit a registration application along with a balance sheet as required under Section 14 of the Sales Tax Act, 1990.

- Verification will be carried out by the Local Registration Office (LRO), after which a registration order will be issued.

Biometric verification is now mandatory on an annual basis.

Sales

- If the declared capital is less than five times the declared sales, prior approval from the Commissioner is required.

Input Tax Adjustment

- Input tax invoices will be disallowed if the supplier fails to file their return within the same month.

- Input tax on such purchases cannot be claimed.

- In cases where the supplier fails to file the return, the entire input tax must be borne by the purchaser

This notification addresses the following three key areas:

1. Registration

2. Sales

3. Input Tax Adjustment

Target Registered Persons are :

- Individuals

- AOP

- Single Member Company

Note : Manufacturers are not included in the said SRO

Registration :

- Taxpayers must submit a registration application along with a balance sheet as required under Section 14 of the Sales Tax Act, 1990.

- Verification will be carried out by the Local Registration Office (LRO), after which a registration order will be issued.

Biometric verification is now mandatory on an annual basis.

Sales

- If the declared capital is less than five times the declared sales, prior approval from the Commissioner is required.

Input Tax Adjustment

- Input tax invoices will be disallowed if the supplier fails to file their return within the same month.

- Input tax on such purchases cannot be claimed.

- In cases where the supplier fails to file the return, the entire input tax must be borne by the purchaser