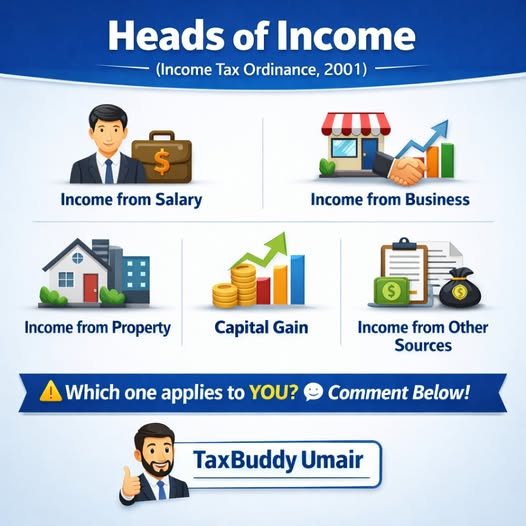

What is Considered Salary for Tax Purposes?

Section 12: Salary – Income Tax Ordinance, 2001

Understanding Salary for Tax Purposes in Pakistan

Under Section 12 of the Income Tax Ordinance, 2001, the term salary has a broad meaning that goes beyond basic pay. For tax purposes, salary includes not only the amount received in cash but also various allowances, benefits, and perquisites provided by the employer.

What Is Considered Salary?

According to the Ordinance, salary includes any amount received by an employee—directly or indirectly—from an employer, whether in monetary or non-monetary form. This means that every payment or benefit linked to employment can potentially fall under the salary category for taxation.