Why Do People in Pakistan Want to Become Filers?

Why Do People in Pakistan Want to Become Filers?

In Pakistan, becoming a tax filer is no longer just about civic duty — it’s a practical financial decision. Many people don’t file out of love for paying taxes; instead, they do it to enjoy the benefits of being on the Active Taxpayers List (ATL) maintained by the Federal Board of Revenue (FBR).

If you’re a non-filer, you end up paying higher taxes and facing more restrictions. But if you’re a filer, you can legally save money, enjoy smoother transactions, and avoid unnecessary penalties.

This blog explains the main reasons why people in Pakistan want to become filers, who benefits the most, and answers some common questions.

Who Exactly is a Filer in Pakistan?

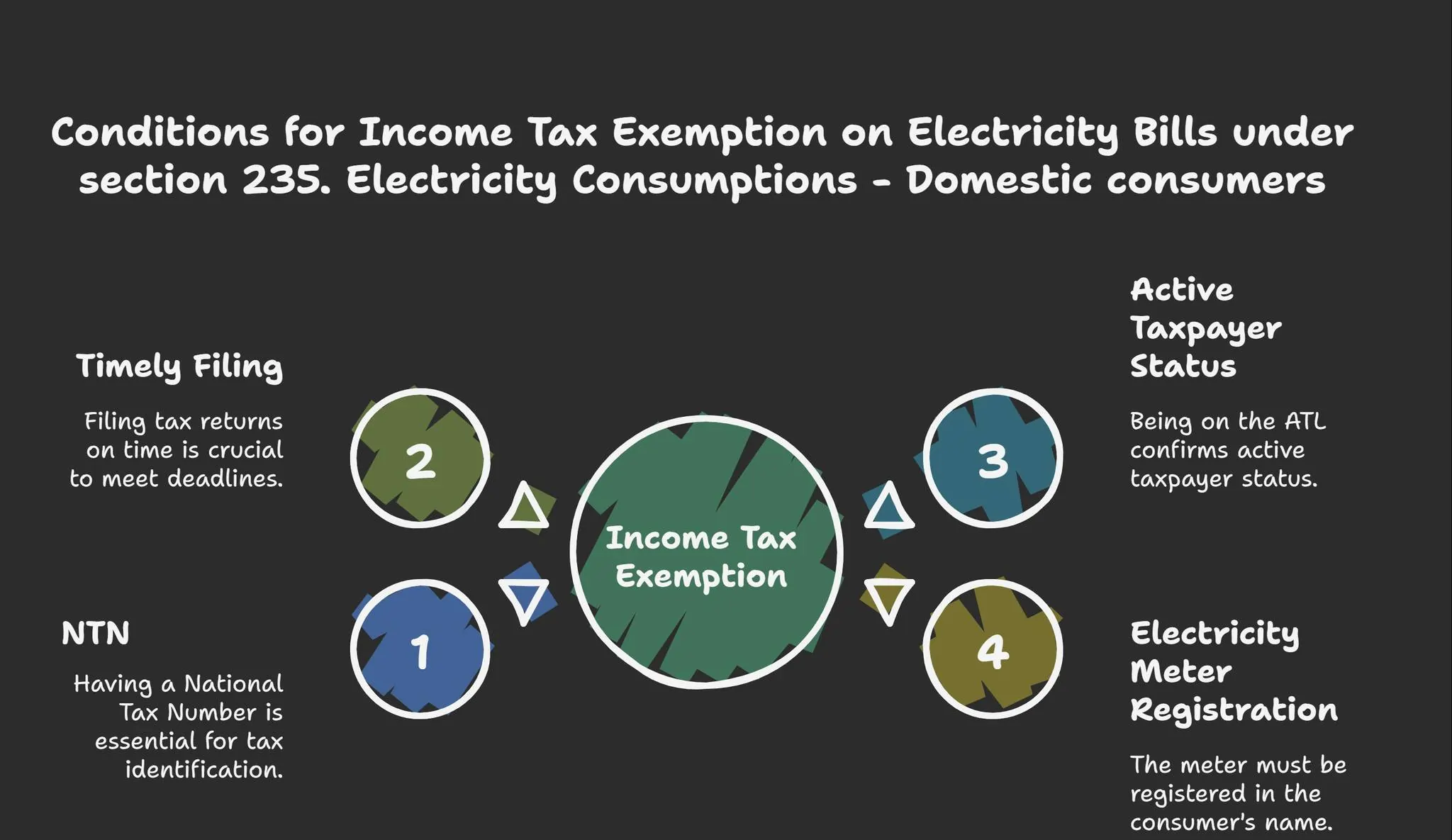

A filer is a taxpayer whose name appears on the Active Taxpayers List (ATL) published by the FBR every year. To be included, you must file your annual income tax return and wealth statement (if applicable).

If you are not on the ATL, you are treated as a non-filer and face double or even higher tax rates on many financial transactions.

Why People Become Filers :

Here are the most common types of people who actively seek filer status in Pakistan:

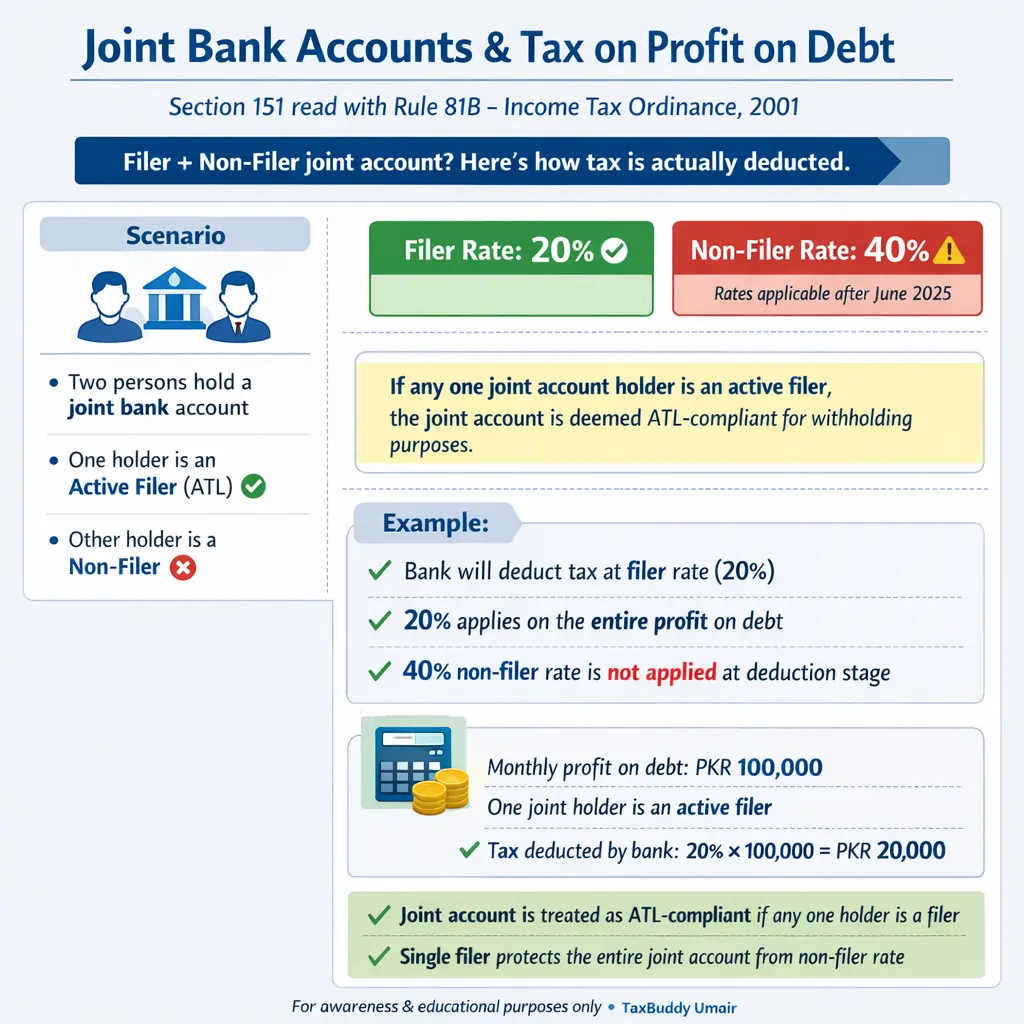

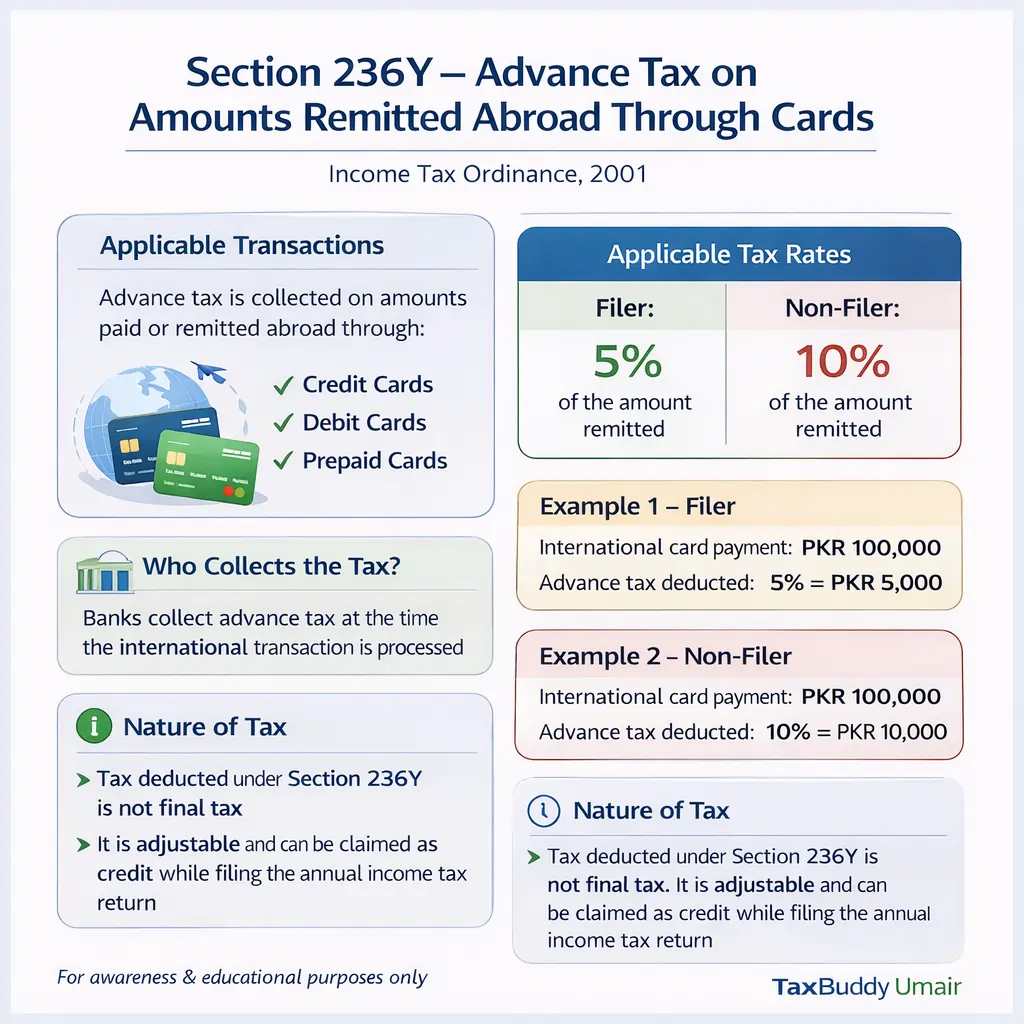

Investors

Bank savings, fixed deposits, and investment accounts are taxed at a lower rate for filers. Non-filers face much higher withholding tax on profit from debt. For example, filers may pay 20% while non-filers can pay up to 40%.

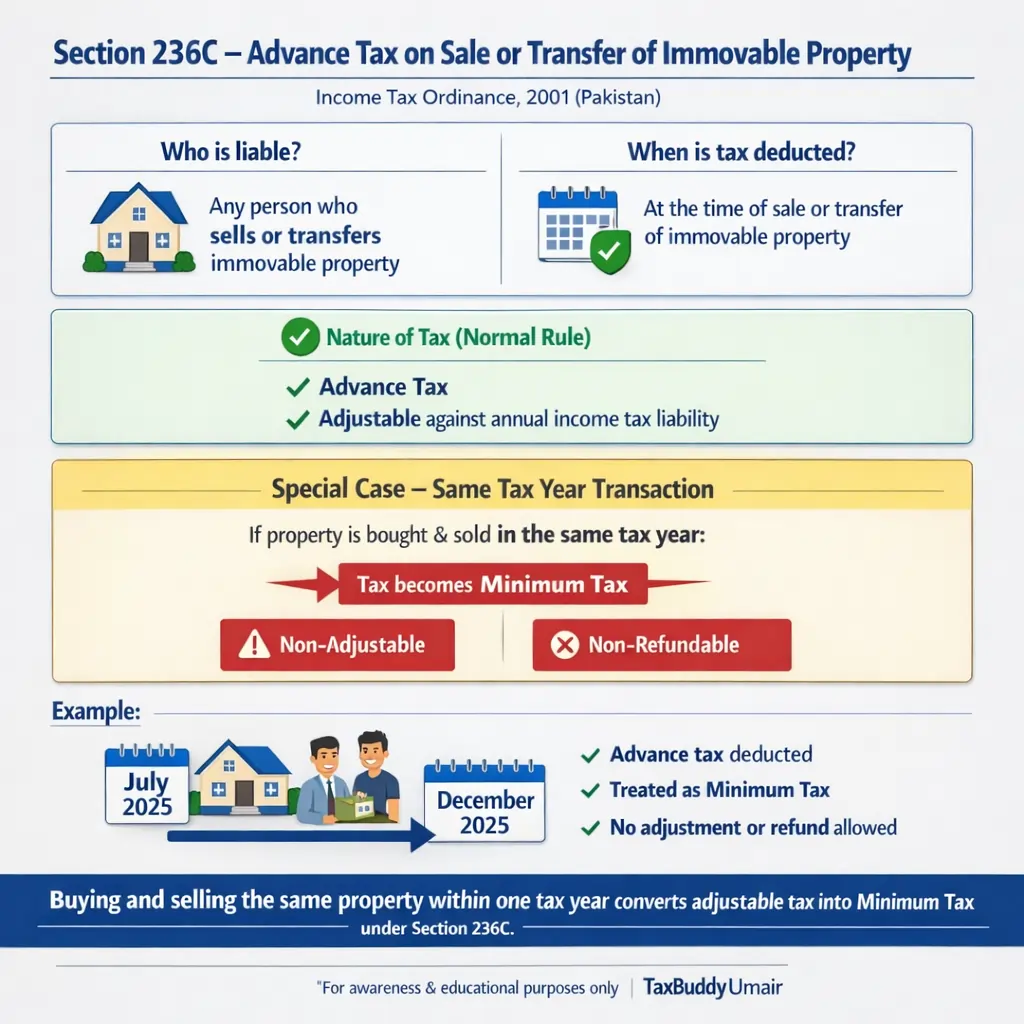

Property Buyers

If you’re purchasing immovable property (plots, houses, apartments), being a filer means reduced tax at the time of registration and transfer. Non-filers often pay double the tax rate.

Property Sellers

Selling property also comes with withholding tax, but filers enjoy a lower deduction compared to non-filers. For frequent investors in real estate, this difference can save lakhs of rupees.

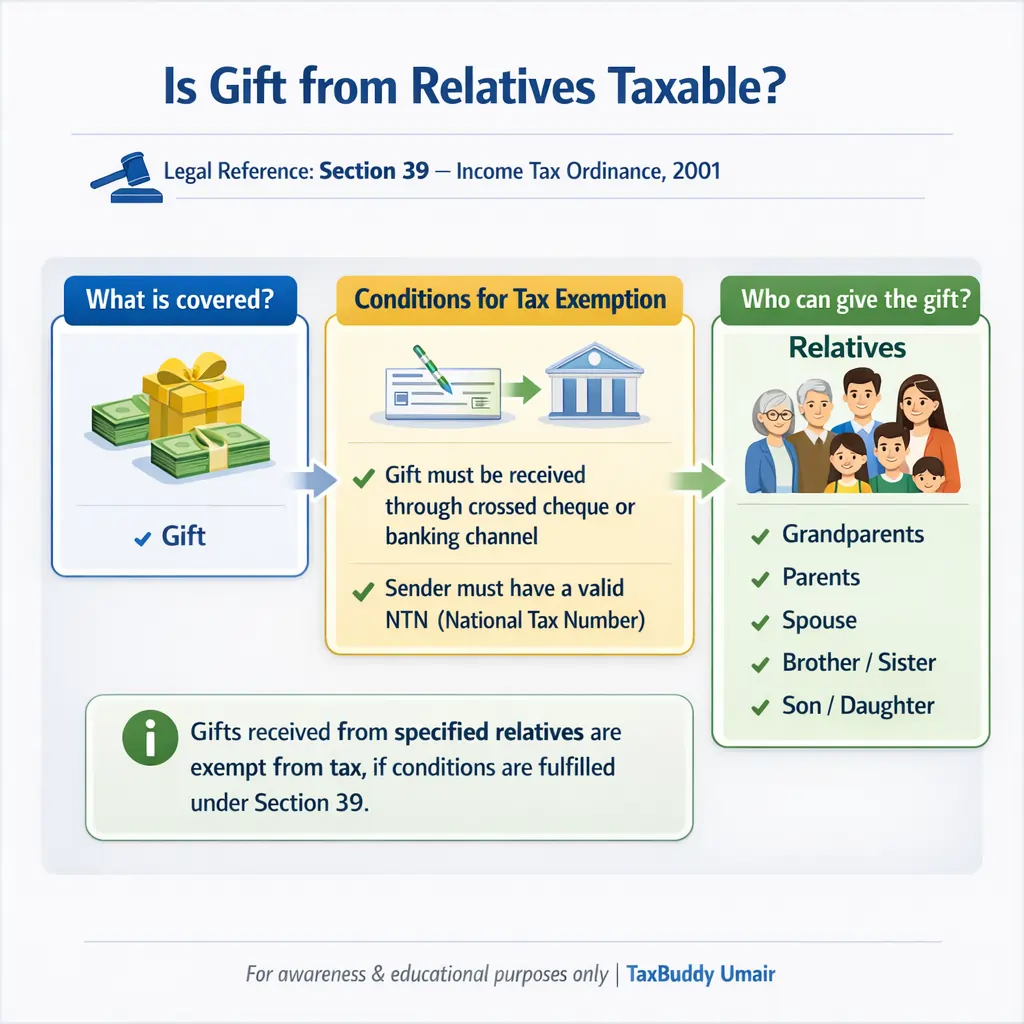

Inheritance & Gift Transfers

When property is transferred as a gift or inheritance, filers face smoother processes and lower costs. Non-filers often run into higher tax deductions and longer documentation requirements.

Vehicle Buyers

Whether you’re registering a new car or paying annual token tax, the difference is huge. For example, token tax for a filer can be half of what a non-filer pays. Vehicle registration fees are also much cheaper for filers.