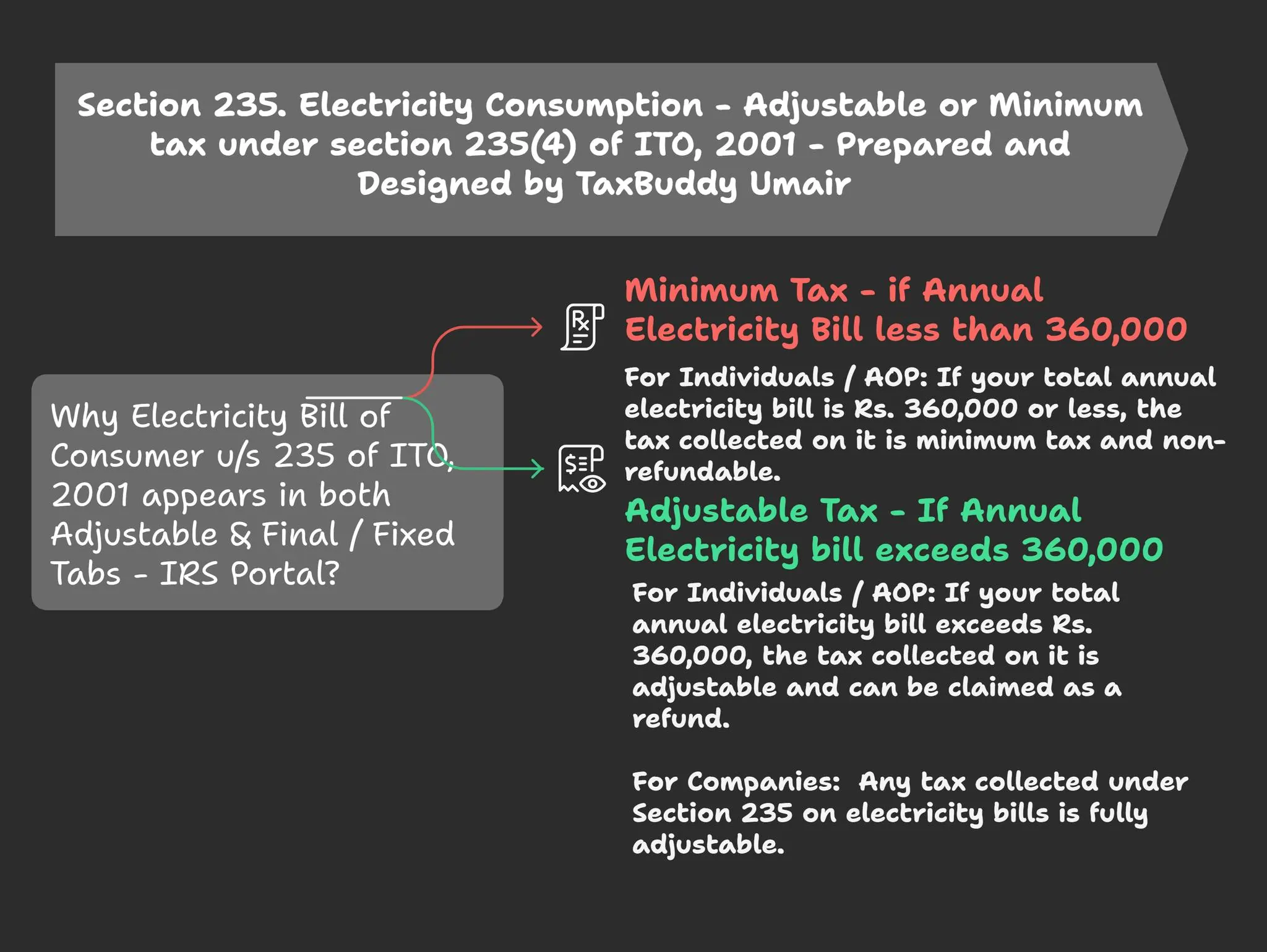

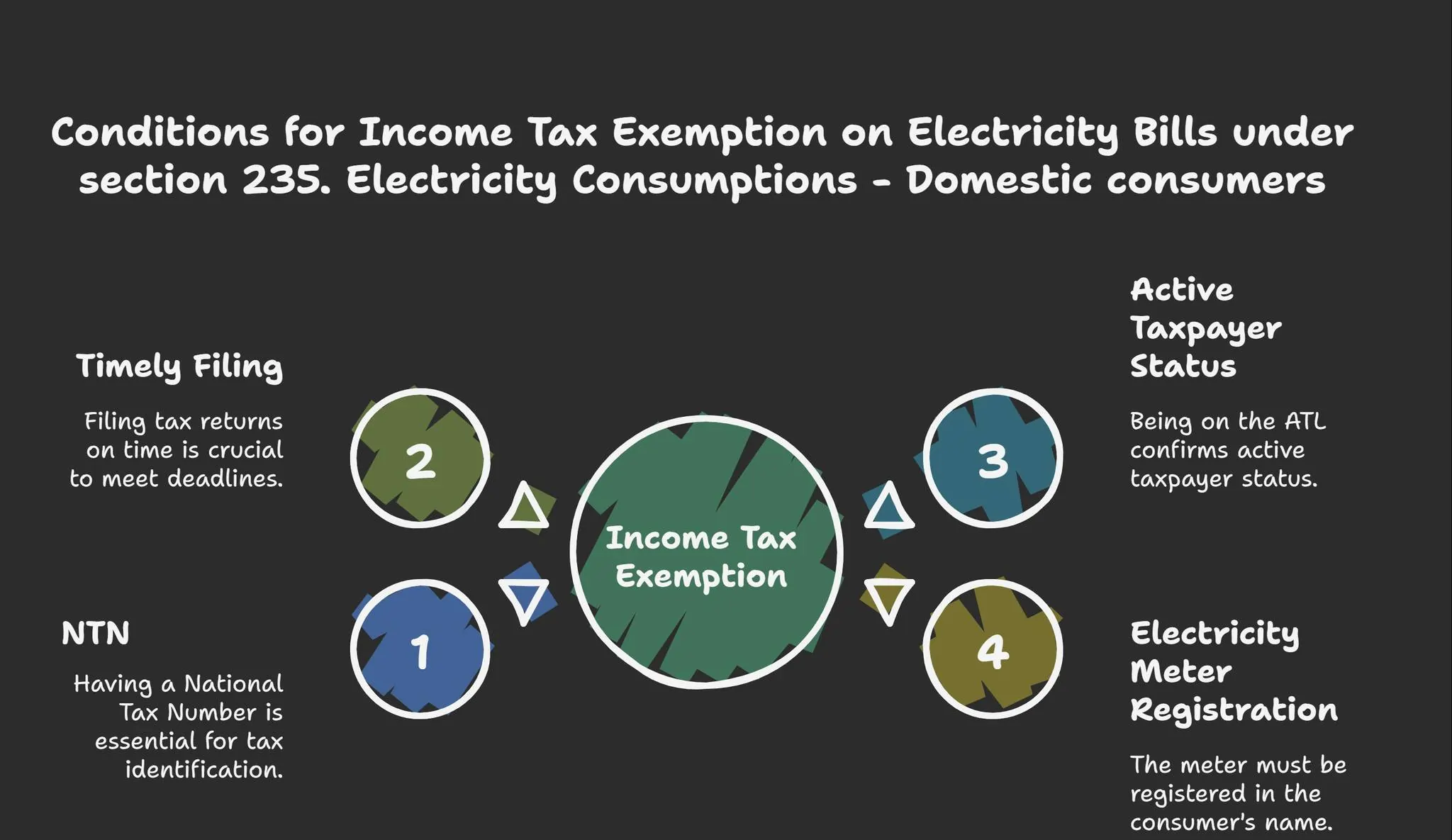

Why the Electricity Bill of Consumer u/s 235 appears in both the tabs like Adjustable / Fixed Tax Regime tab?

Legal Reference: Section 235(4). Electricity Consumption – Income Tax Ordinance, 2001

For Individuals / AOP: If your total annual electricity bill is Rs. 360,000 or less, the tax collected on it is minimum tax and non-refundable.

For Individuals / AOP: If your total annual electricity bill exceeds Rs. 360,000, the tax collected on it is adjustable and can be claimed as a refund.

For Companies: Any tax collected under Section 235 on electricity bills is fully adjustable.

Leave a Comment