Advance tax on sale to cigarettes products

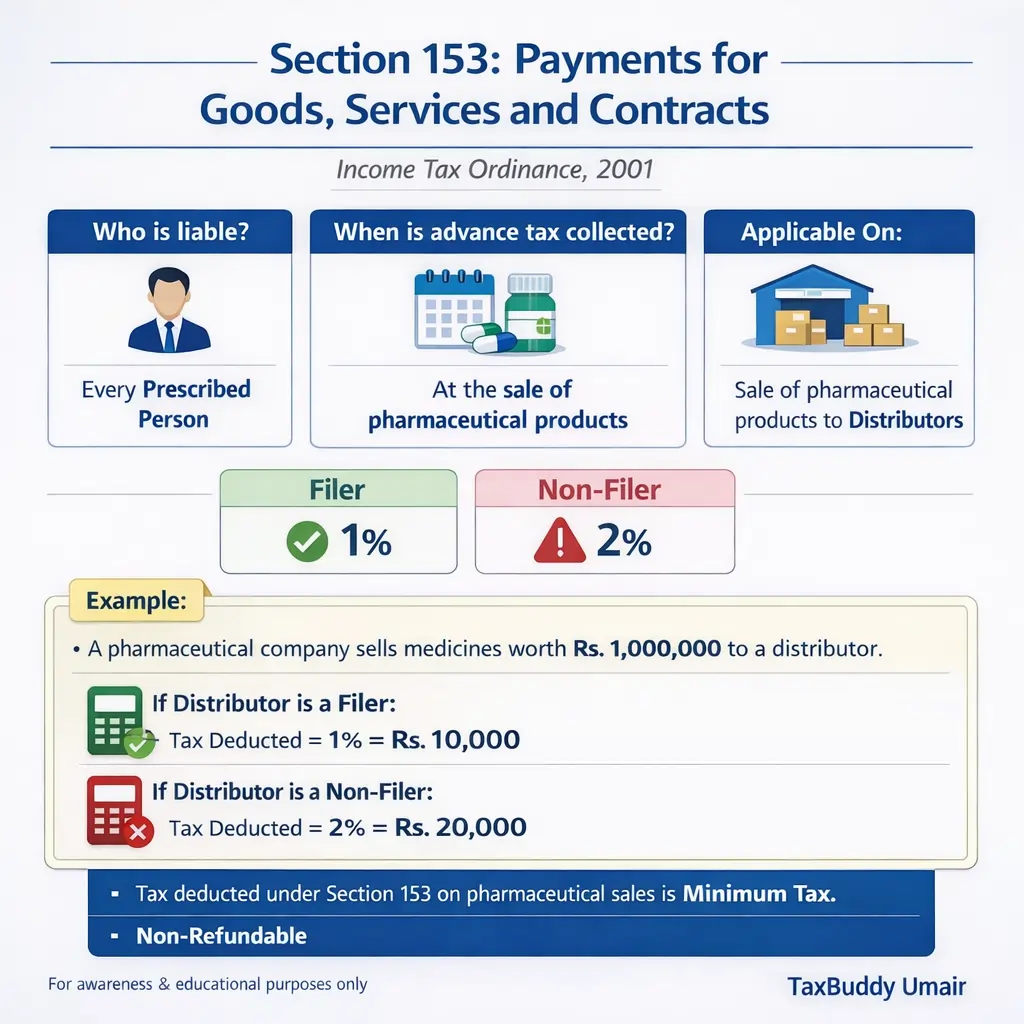

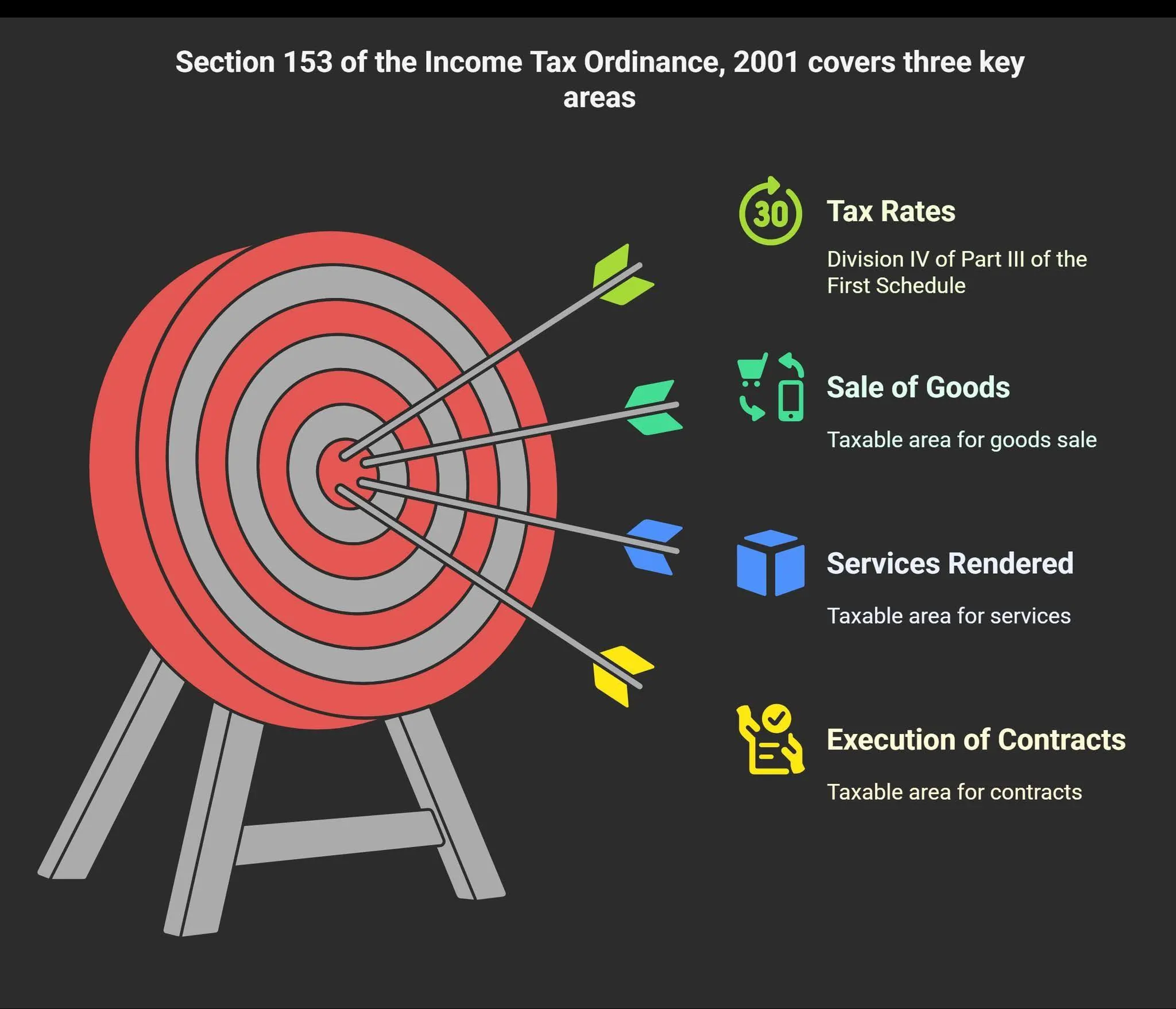

Section 153: Payments for goods, services and contracts - ITO, 2001.

Legal Reference : 24(A) Second Schedule Part II, Income Tax Ordinance, 2001

Advance tax on cigarettes products

Every prescribed person, at the time of the sale of cigarettes products shall collect Advanced tax based on the Filing status of the taxpayers:

For the sale of cigarettes products to Distributor:

Filer Tax Rate: 2.5%

Non-Filer Tax Rate: 5%

Example : A cigarettes company sell cigarettes products worth Rs.1,000,000 to a distributor

If Distributor is a Filer :

Advanced Tax Collected at the time of sale of cigarettes products = 1,000,000 * 2.5% = Rs, 25,000 (will be deposited into FBR)

If Distributor is a Non Filer :

Advanced Tax Collected at the time of sale of cigarettes products = 1,000,000 * 5% = Rs, 50,000 (will be deposited into FBR)

Note: tax collected on the sale of cigarettes products is treated as Minimum Tax and non refundable