Do Bakery Shops Fall Under Tier-1 Retailers Pakistan

Do Bakery Shops Fall Under the Scope of Tier-1 Retailers in Pakistan?

Section 2(43A) – Tier-1 Retailers | Sales Tax Act, 1990

Bakery shops are a common sight in almost every neighborhood across Pakistan. From early morning until late at night, these bakeries sell bread, cakes, biscuits, sweets, and other bakery items to walk-in customers. Because many bakery shops operate on a small or medium scale, owners often assume that Tier-1 Retailer rules do not apply to them.

This raises an important and practical question:

Do Bakery shops fall under the scope of Tier-1 Retailers as defined in the Sales Tax Act, 1990?

The short answer is yes—under certain conditions. This article explains when and why a bakery shop becomes a Tier-1 Retailer, using Section 2(43A) of the Sales Tax Act, 1990, in simple and easy-to-understand terms.

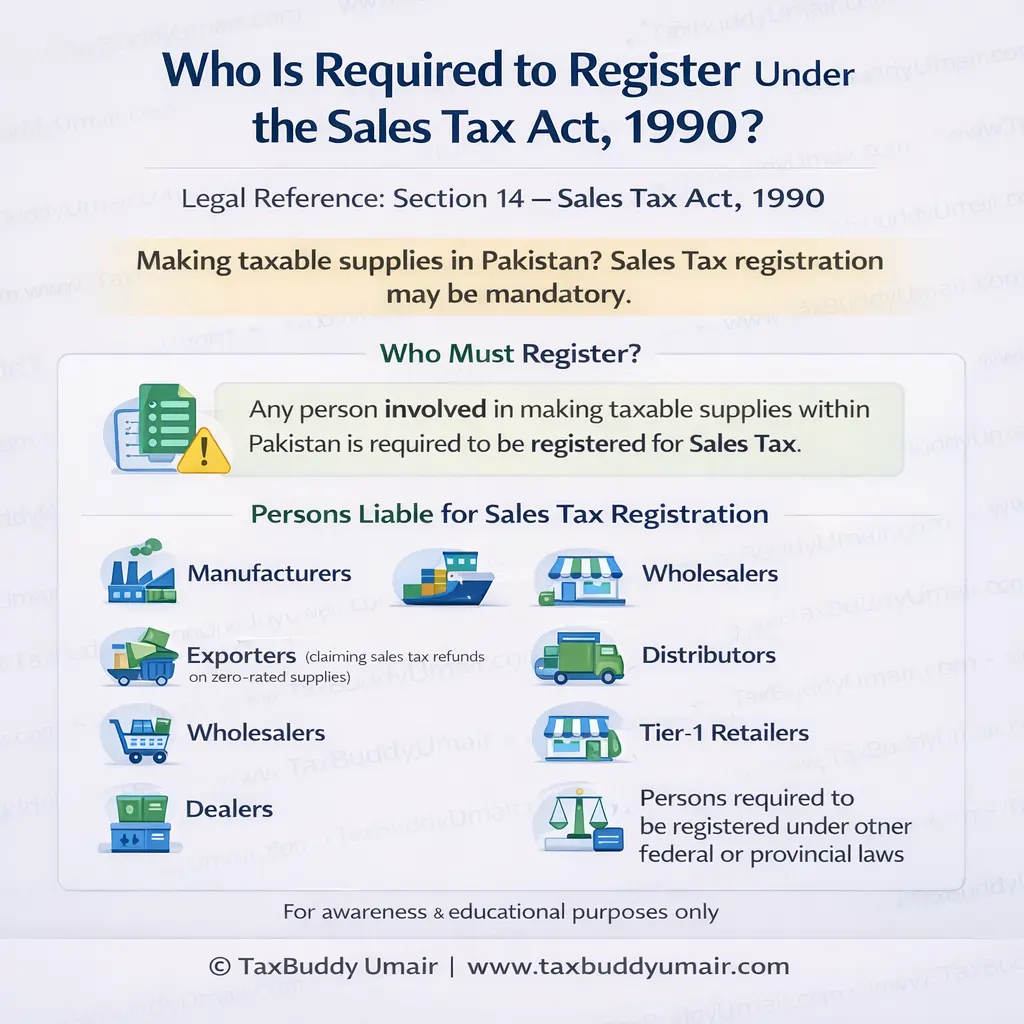

Understanding Tier-1 Retailers Under the Law

Under Section 2(43A) of the Sales Tax Act, 1990, Tier-1 Retailer status is not based on the type of business alone. It does not matter whether a shop is a bakery, grocery store, or any other retail outlet.

Instead, the law focuses on specific operational indicators, such as:

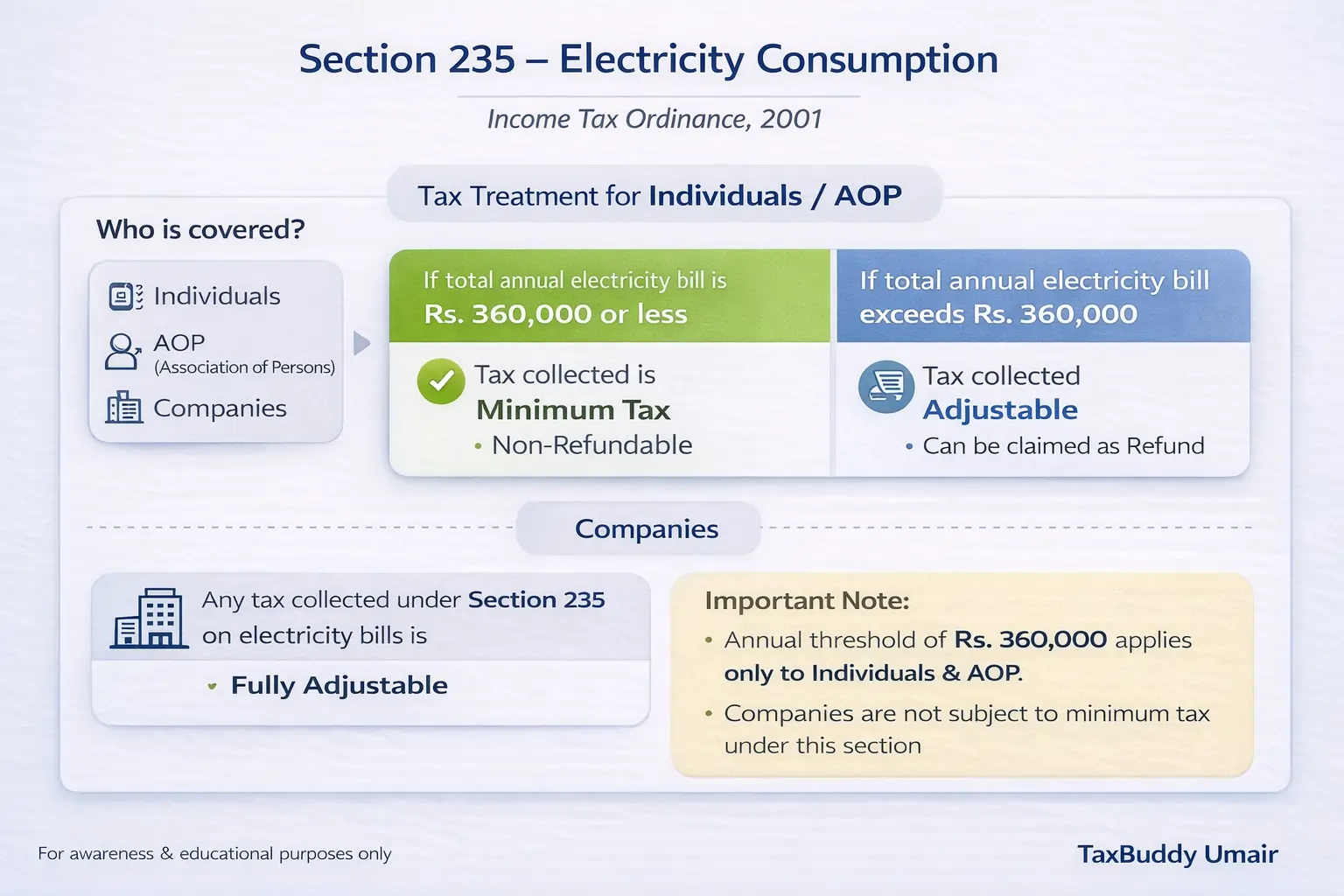

- Electricity consumption

- Mode of receiving payments from customers

This means that even a small neighborhood bakery can fall under the Tier-1 Retailer category if it meets any one of the prescribed conditions.

Why Bakery Shops Are Often Overlooked

Most bakery owners believe that Tier-1 Retailer rules apply only to:

- Large retail chains

- Shopping malls

- Supermarkets

However, bakery shops often:

- Use heavy electric ovens, mixers, and refrigeration units

- Operate long hours (sometimes 16–18 hours a day)

- Accept card payments for customer convenience

Because of this, many bakery shops unknowingly meet the legal thresholds set out in the law.

Conditions That Make a Bakery Shop a Tier-1 Retailer

A bakery shop will fall under the definition of a Tier-1 Retailer if it meets any one of the following conditions under Section 2(43A).

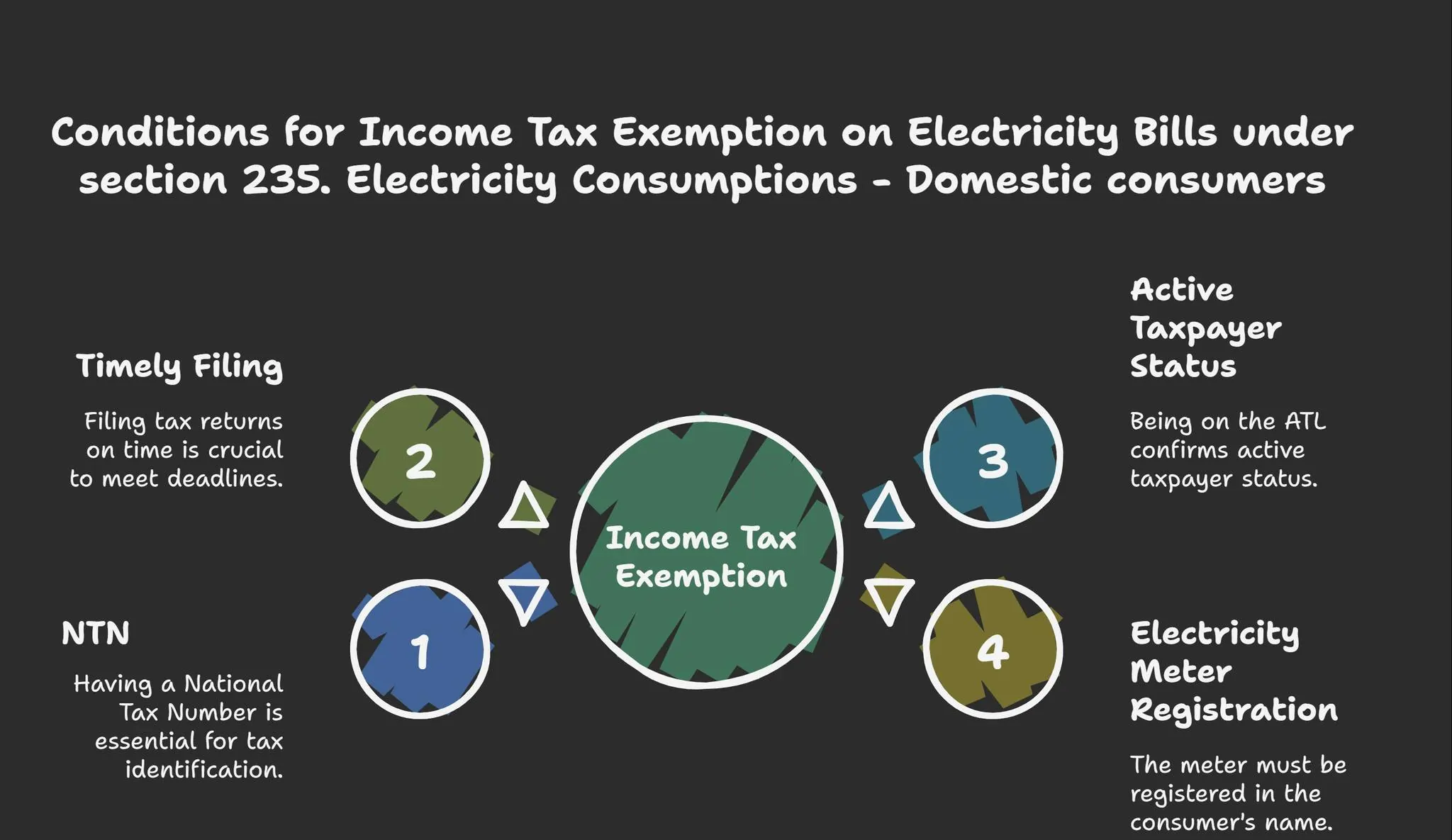

1. Electricity Consumption Threshold

One of the most important conditions relates to electricity usage.

What Does the Law Say?

If a bakery shop’s annual electricity bills exceed Rs. 1,200,000, it is classified as a Tier-1 Retailer.

This condition is particularly relevant for bakery shops because:

- Baking ovens consume high electricity

- Refrigerators and freezers run continuously

- Long operating hours increase power consumption

- Many bakery owners cross this threshold without realizing it, simply due to day-to-day operations.

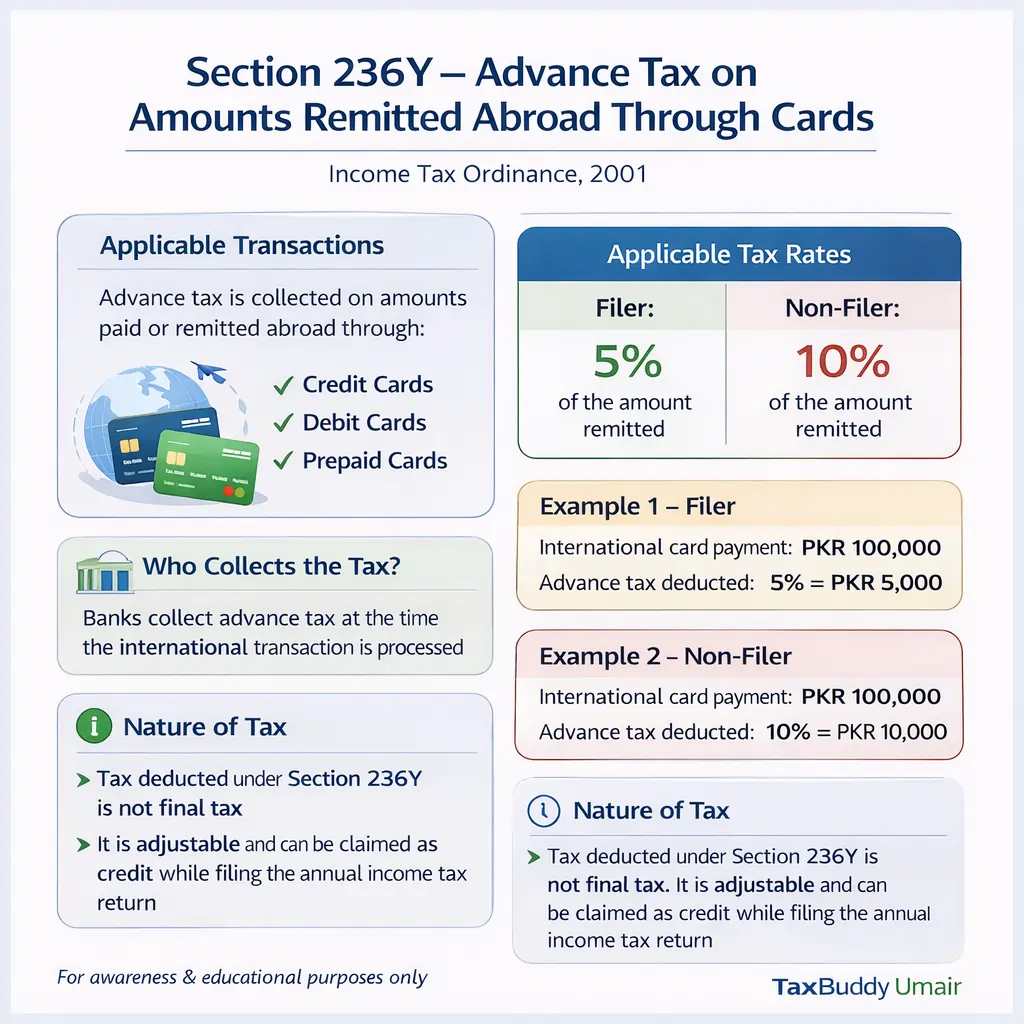

2. Acceptance of Electronic Payments

The second key condition is related to how customers make payments.

- Electronic Payment Acceptance Includes:

- Debit card payments

- Debit card payments

If a bakery shop accepts payments through debit or credit card machines, it automatically qualifies as a Tier-1 Retailer, regardless of: Shop size, Sales volume & Location

A common misunderstanding is that both conditions must be met.

This is not correct. Meeting even one condition —either electricity consumption or electronic payment acceptance—is enough to classify a bakery shop as a Tier-1 Retailer.