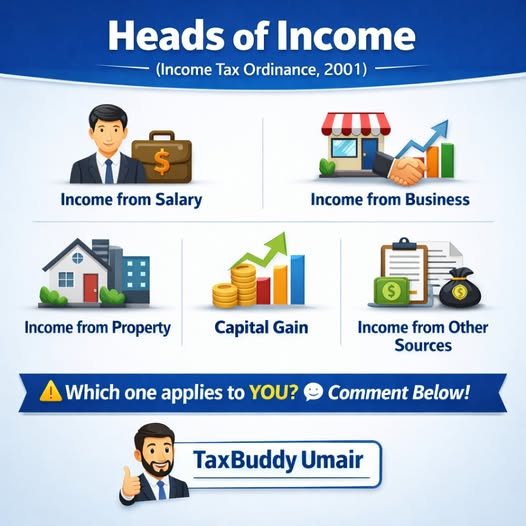

List of Withholding Tax Sections Deduction of Tax at Source under the Income Tax Ordinance

What is Withholding Tax ?

Withholding Tax refers to the tax that the payer deducts at the time of making a Payment and Deposits it with the Federal Board of Revenue on behalf of the recipient.

List of Withholding Tax Sections – Deduction of Tax at Source under the Income Tax Ordinance, 2001 :

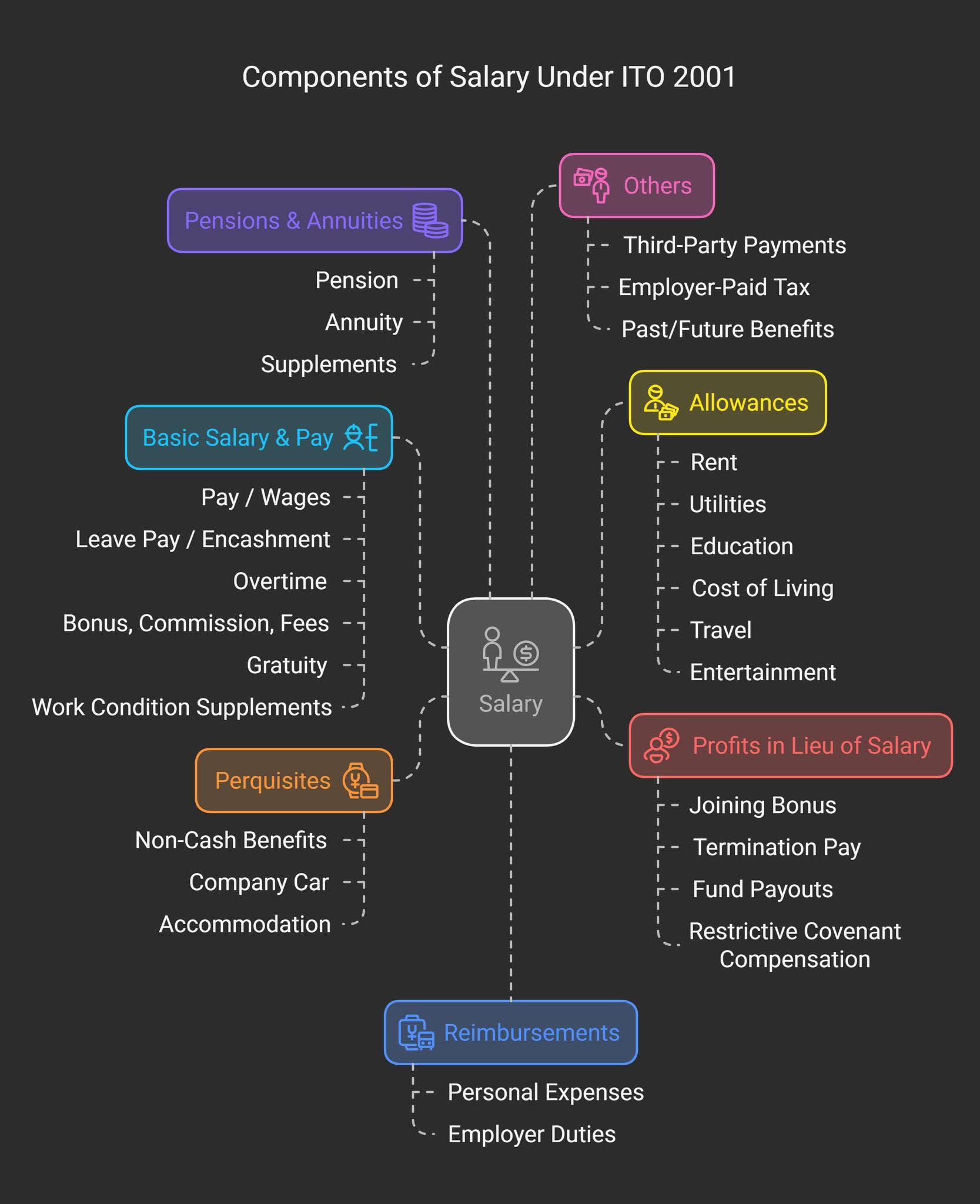

Section 149. Salary

Section 150. Dividends

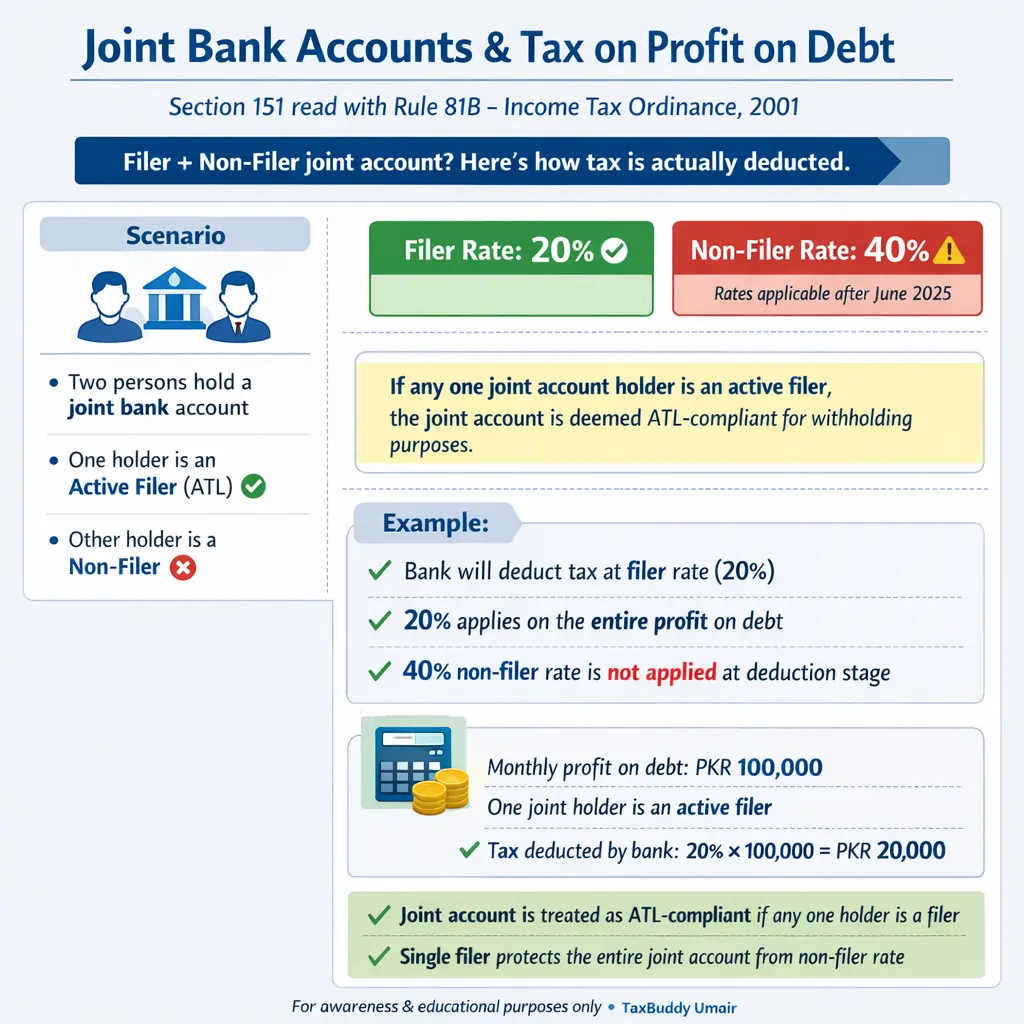

Section 151. Profit on debt

Section 152. Payment to non-residents

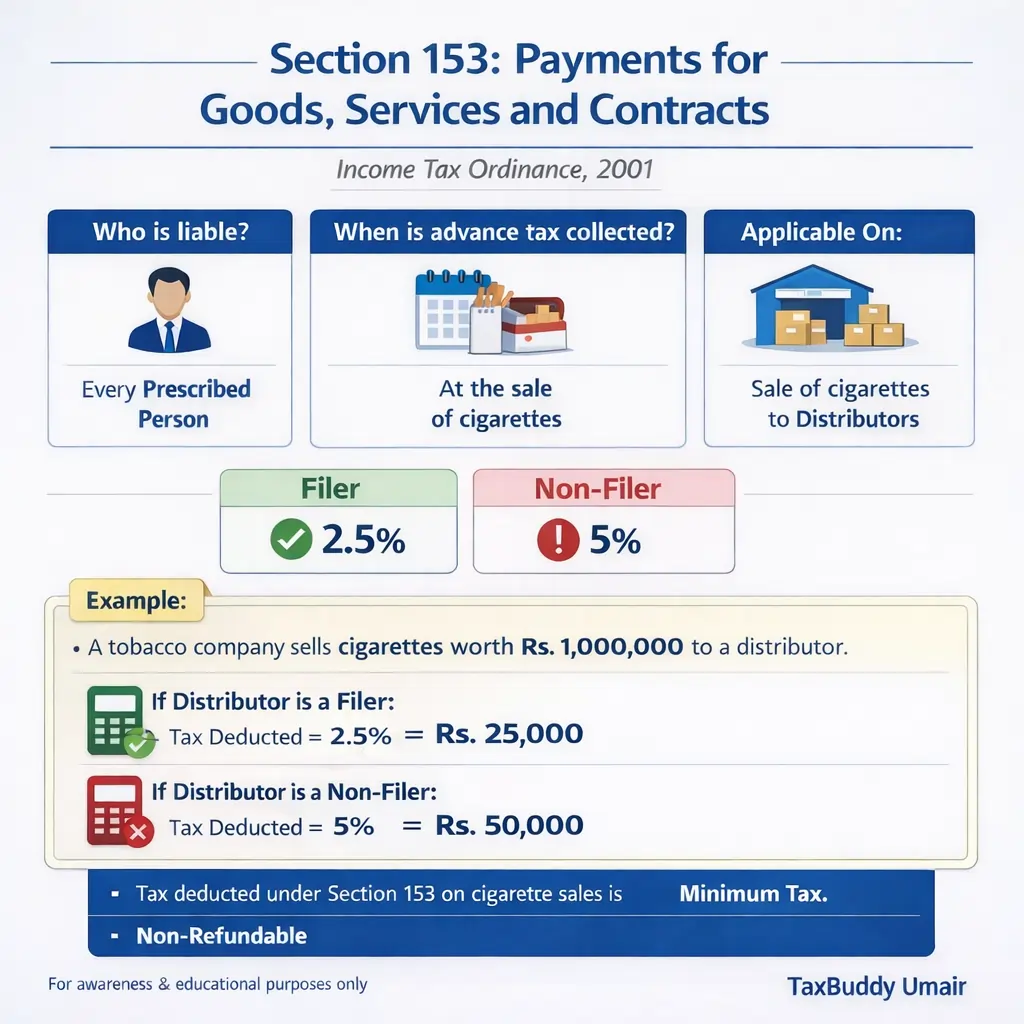

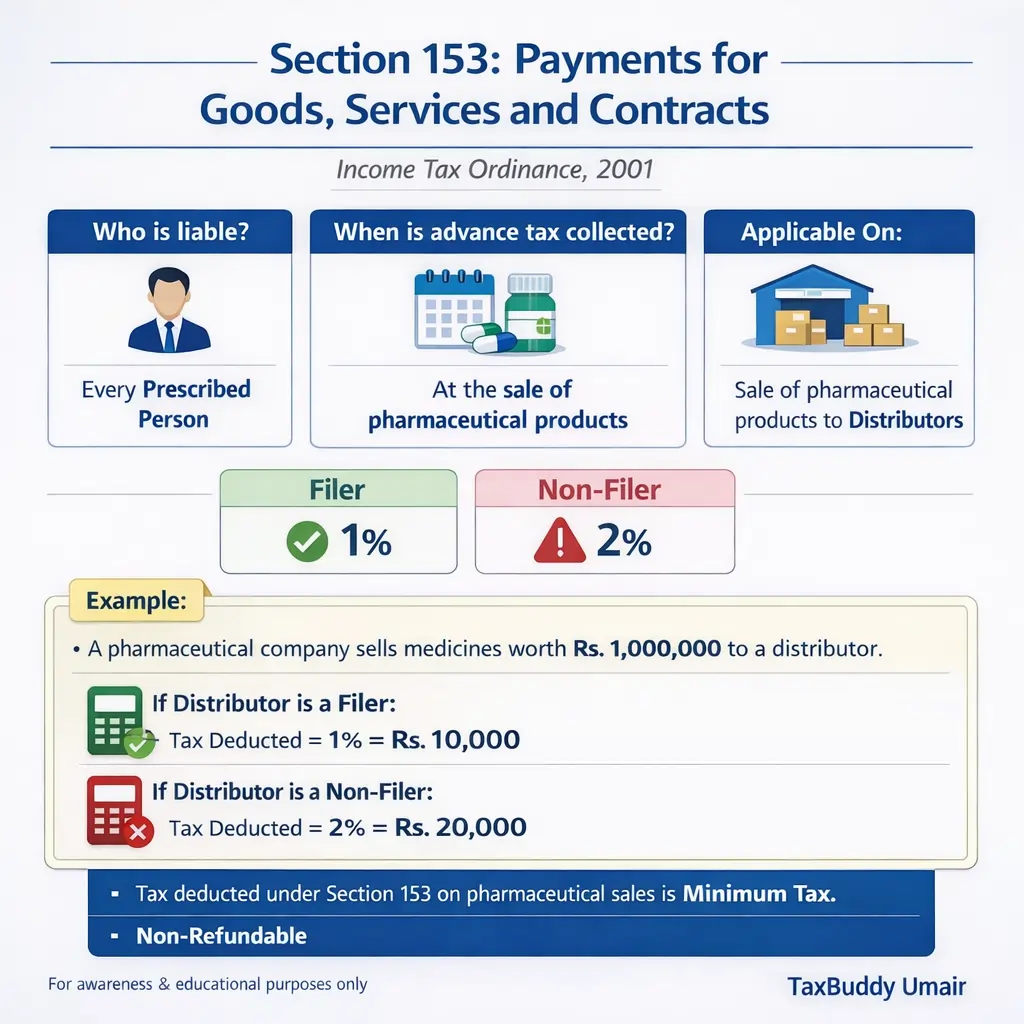

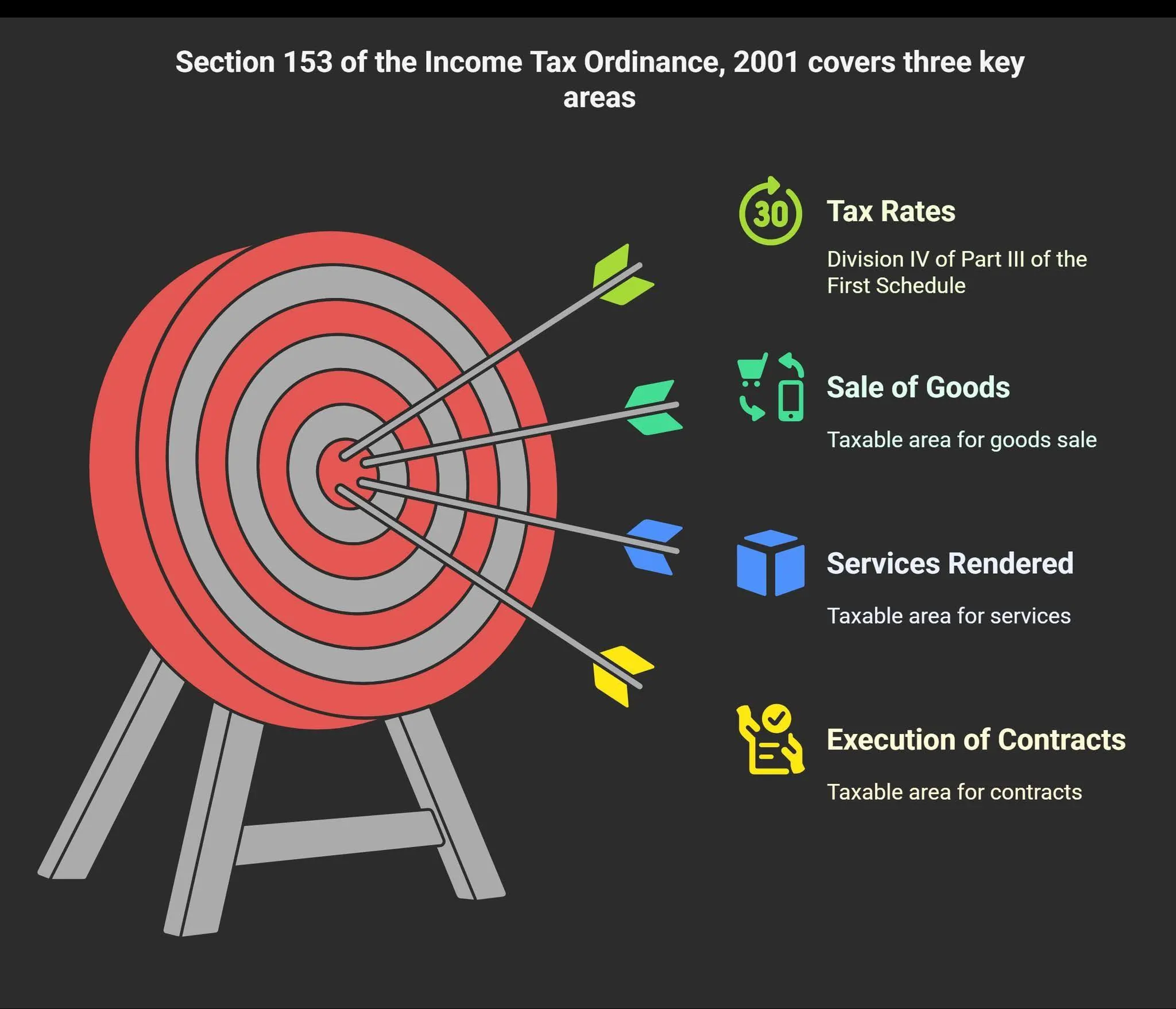

Section 153. Payments for goods, services and contracts

Section 154. Exports

Section 154A. Export of Services

Section 155. Rent of immoveable property

Section 156. Prizes and winnings

Section 156A. Petroleum products