taxability of gifts from relatives section 39

Under Section 39 read with sub-section (3) of the Income Tax Ordinance, 2001, any amount received as a loan, advance, deposit (including for issuance of shares), or gift from specified relatives is not taxable.

if following conditions are met :

- The amount is received through crossed cheque, banking channel, or approved digital means, and

- The sender holds a valid National Tax Number (NTN).

Specified relatives include:

- grandparents

- parents

- spouse

- brother

- sister

- son, or daughter.

However, if any loan, advance, deposit, or gift (even from relatives) is:

- received otherwise than through crossed cheque, banking channel, or approved digital means, or

- received from a specified relatives not holding a valid NTN,

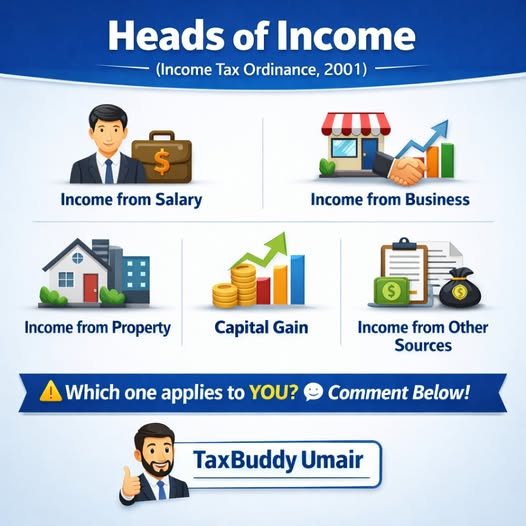

Note: Such amount shall be treated as income chargeable to tax under the head Income from Other Sources in the tax year in which it is received.