What is Value Addition Tax Sales Tax Act 1990 Pakistan

What Is Value Addition Tax Under the Sales Tax Act, 1990?

Understanding how sales tax works under the Sales Tax Act, 1990 Pakistan becomes much easier when you understand the concept of value addition tax. Many businesses assume that sales tax is charged on the total sale value at every stage. However, in reality, the system ensures that tax is effectively charged only on the value added at each stage of the transaction.

This article explains the concept in a clear and practical manner.

Sales Tax Is Based on Two Core Transactions

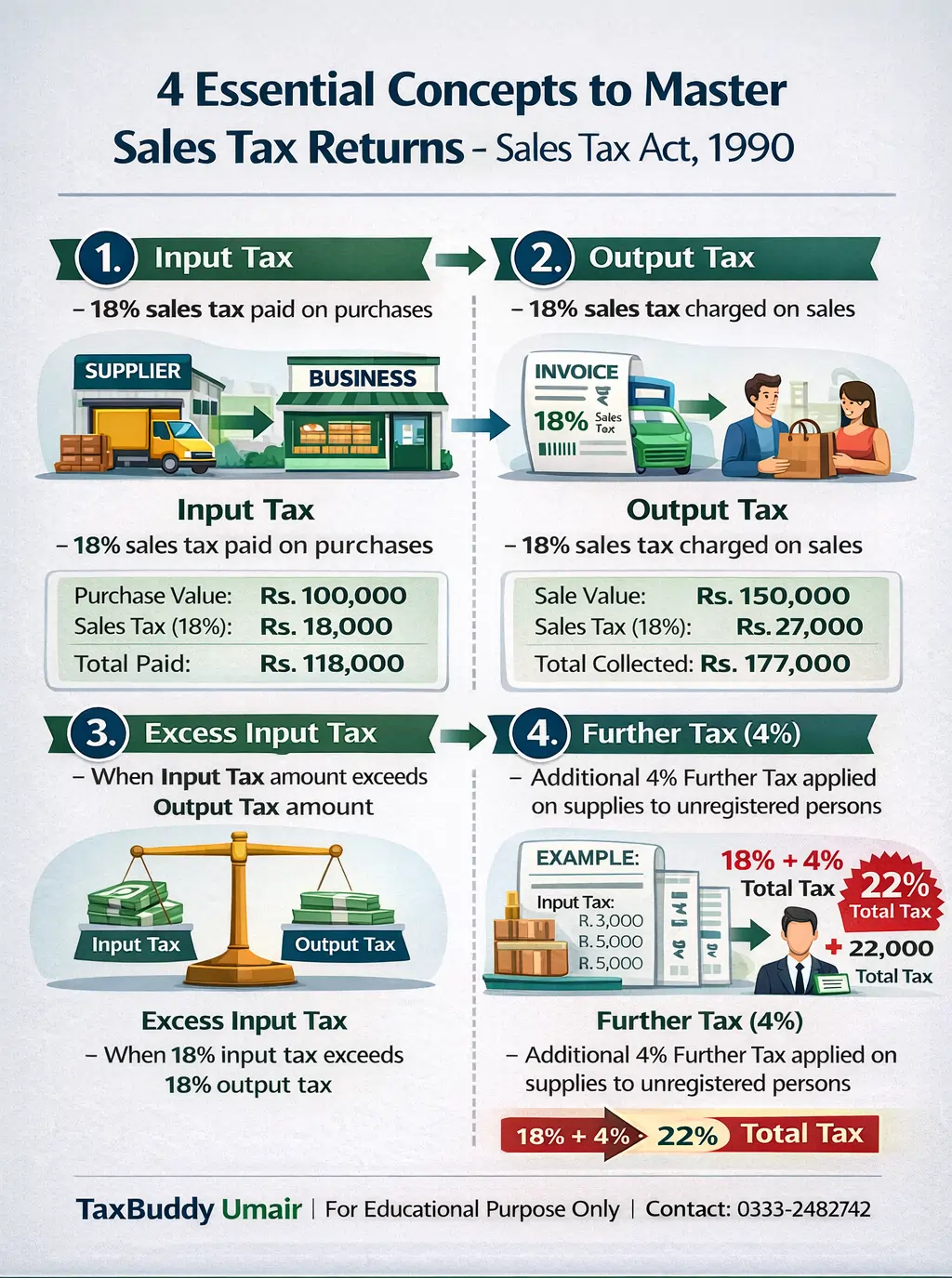

Under the Sales Tax Act, 1990, sales tax revolves around two main transactions:

- Purchases

- Sales

The law categorizes tax in the following way:

- Input Tax – Sales tax paid on purchases

- Output Tax – Sales tax charged on sales

Note: The difference between these two determines the final tax liability.

Sales Tax Liability Formula

The formula used to calculate sales tax payable is:

Sales Tax Liability = Output Tax – Input Tax

This mechanism ensures that sales tax is paid only on the value added during the transaction.

Let’s understand this with a practical example.

Practical Example of Value Addition

- Assume Mr. Umair purchases taxable goods from a supplier.

Purchase Transaction

- Purchase Price: Rs. 100,000

- Sales Tax (18%): Rs. 18,000

- Input Tax = Rs. 18,000

- Total Purchase Value= Rs. 118,000

The Rs. 18,000 paid to the supplier is input tax. This amount is adjustable against future output tax.

Mr. Umair sells the same goods to a buyer.

Sale Transaction

- Selling Price: Rs. 200,000

- Sales Tax (18%): Rs. 36,000

- Output Tax = Rs. 36,000

- Total Sale Value = Rs. 236,000

The Rs. 36,000 collected from the buyer is output tax.

Calculation of Sales Tax Payable

Using the formula:

Sales Tax Payable = Output Tax – Input Tax

= 36,000 – 18,000 = Rs. 18,000

Mr. Umair will deposit Rs. 18,000 to the government.

So Where Is the Value Addition Tax?

The key concept is that although 18% sales tax is charged at both stages, the business ultimately pays tax only on the value it adds.

Let’s calculate the value added:

Value Added = Selling Price – Purchase Price

= 200,000 – 100,000 = Rs. 100,000

Now calculate tax on value added: 18% of 100,000 = Rs. 18,000

This Rs. 18,000 is exactly the same amount calculated as: Output Tax – Input Tax

This shows that the sales tax system effectively taxes only the value added.

How the Mechanism Works in Practice

At every stage of supply:

- A supplier charges sales tax treated as Output Tax.

- The buyer records that tax treated as Input Tax.

- When the buyer sells further, they charge as Output Tax again.

- They deduct the earlier Input Tax paid against the purchases.

- The difference is paid to the government.

Note : This chain continues until the final consumer, who bears the full tax burden.

Disclaimer : This article is for educational purposes only and does not constitute professional tax advice. For case-specific guidance, consult a qualified tax practitioner.