when wholesalers dealers distributors retailers become tier-1 retailers pakistan

Section 2(43A) – Tier-1 Retailers | Sales Tax Act, 1990

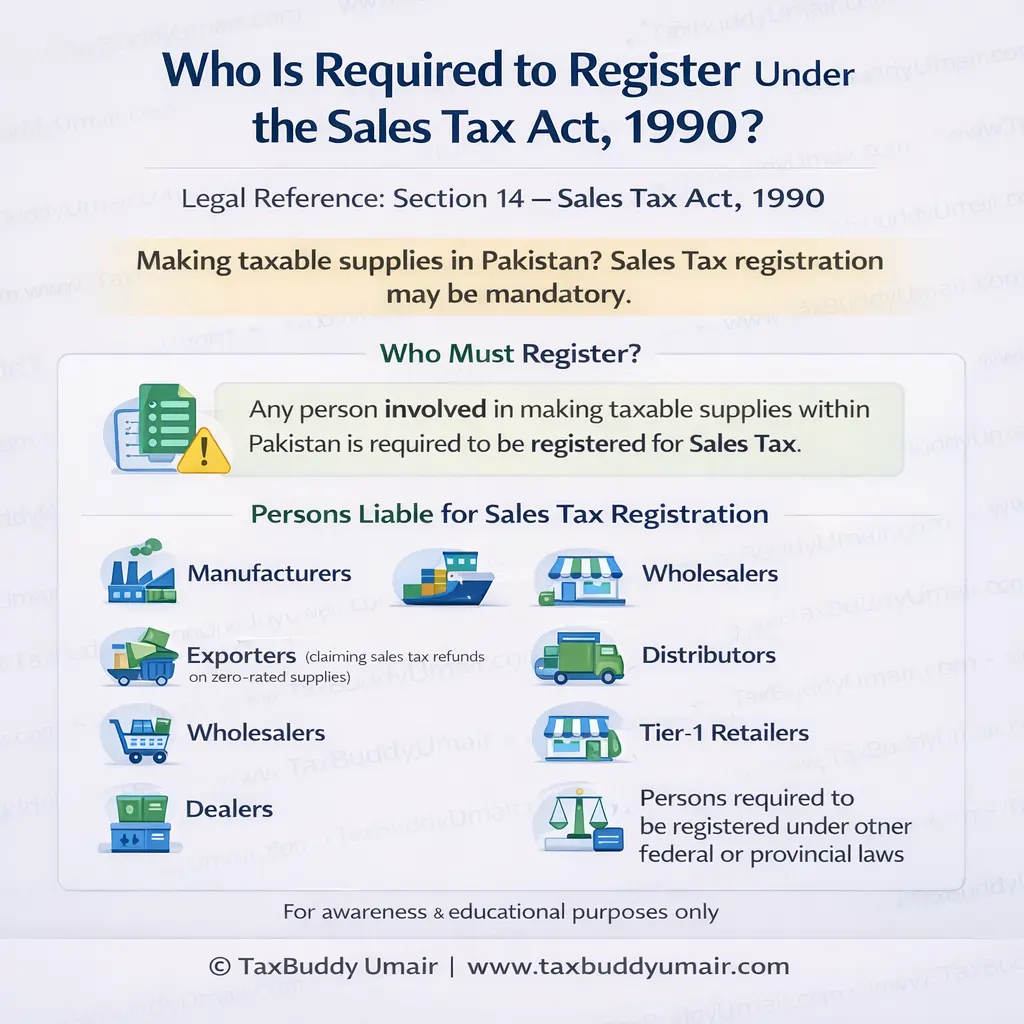

When do wholesalers, dealers, distributors, or retailers fall under the category of Tier-1 Retailers as defined in the Sales Tax Act, 1990?

Many businesses in Pakistan receive tax notices from the Federal Board of Revenue (FBR) and are surprised to learn that they are now classified as Tier-1 Retailers. In most cases, this happens without any formal application by the business itself.

If you are a wholesaler, dealer, distributor, or retailer, understanding this rule is extremely important—because once you become a Tier-1 Retailer, sales tax registration and FBR POS integration become mandatory.

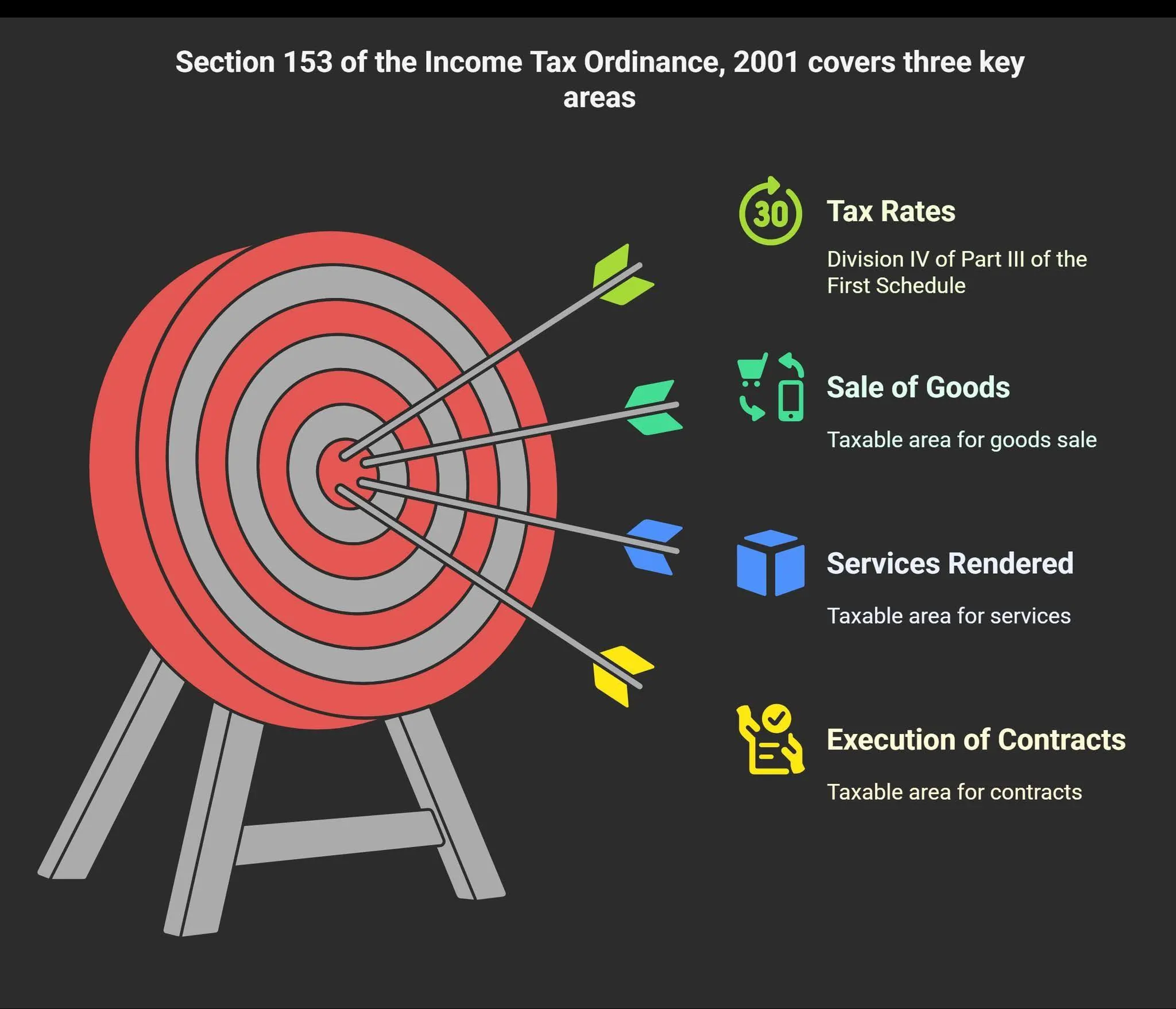

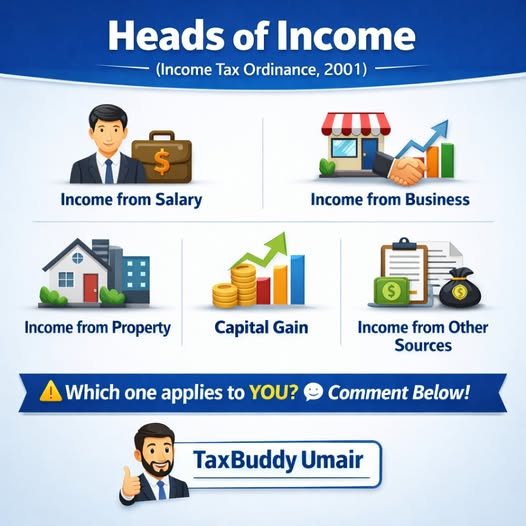

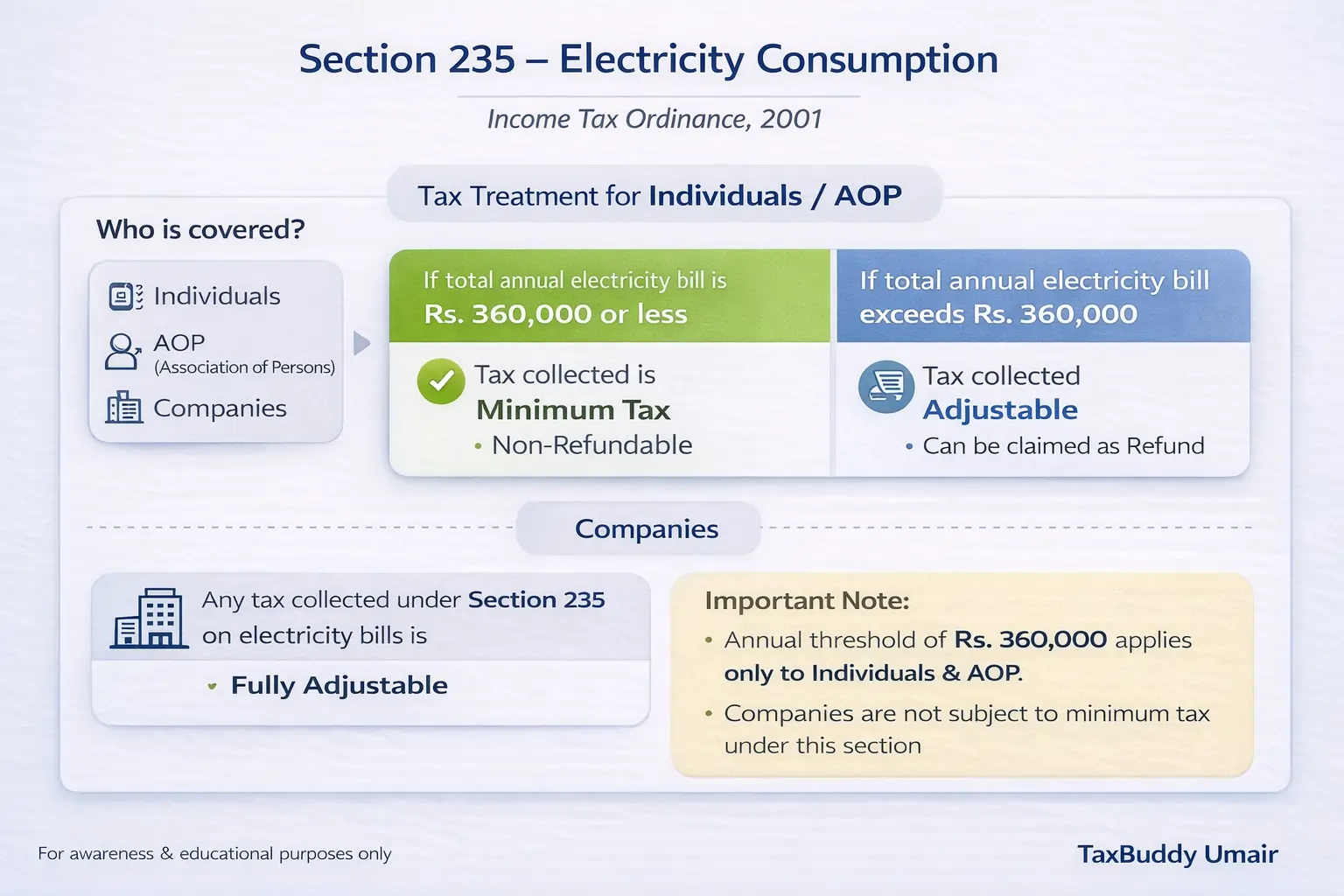

This article explains, in simple words, when and why businesses become Tier-1 Retailers, with reference to Section 2(43A) of the Sales Tax Act, 1990, and Sections 236G and 236H of the Income Tax Ordinance, 2001.

Why Sections 236G and 236H Are So Important

Most businesses overlook Sections 236G and 236H because they fall under income tax, not sales tax. However, these sections are the main trigger for Tier-1 Retailer classification under the Sales Tax Act.

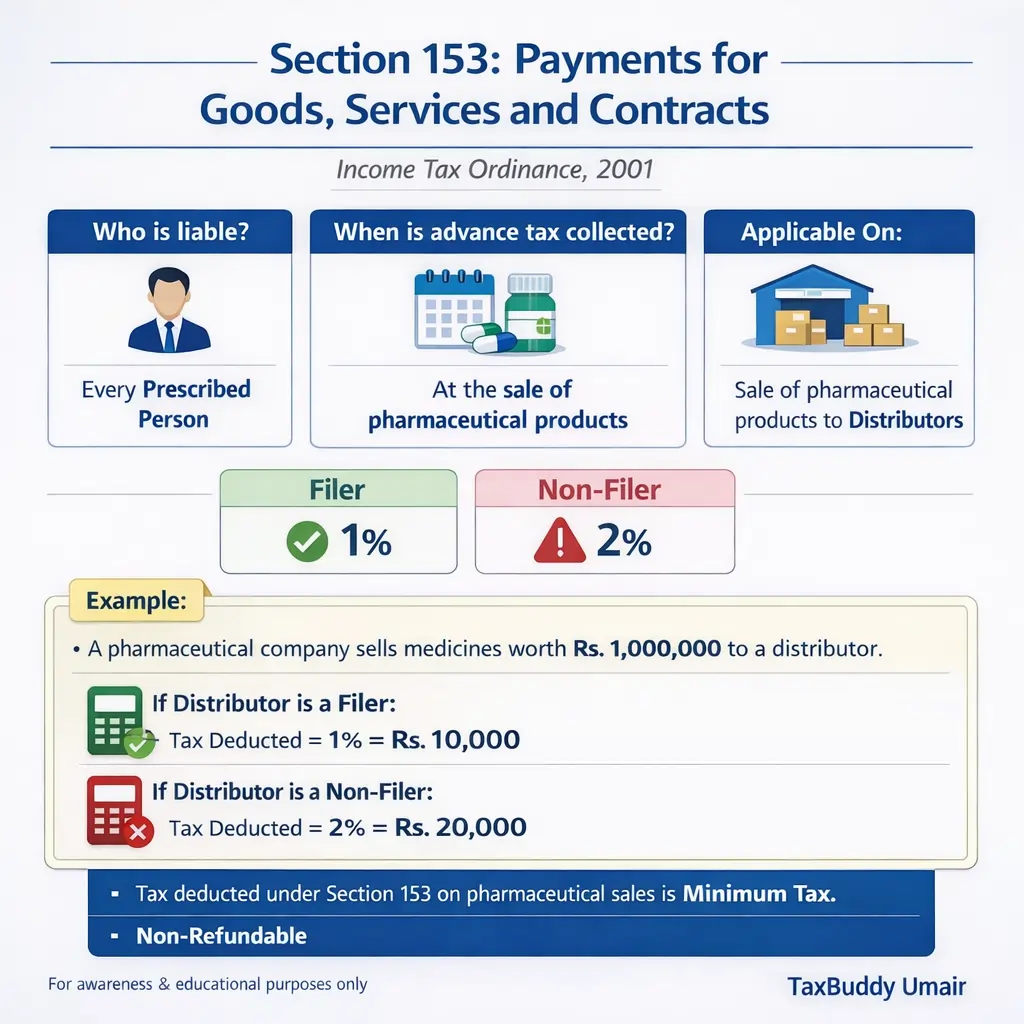

Section 236G – Advance Tax on Sales to Wholesalers, Dealers, and Distributors (ITO, 2001)

Section 236G applies to:

- Wholesalers

- Dealers

- Distributors

When goods are purchased from a manufacturer or importer, advance tax is deducted at source. This tax is deposited in the buyer’s name as advance tax. Many businesses treat this deduction as routine and never review the total tax paid during the year, which later creates compliance issues.

Section 236H – Advance Tax on Sales to Retailers (ITO, 2001)

Section 236H applies specifically to:

- Retailers

Under this section, advance tax is collected on supplies made to retailers. Like Section 236G, the tax paid under this provision is tracked and accumulated by the tax authorities.

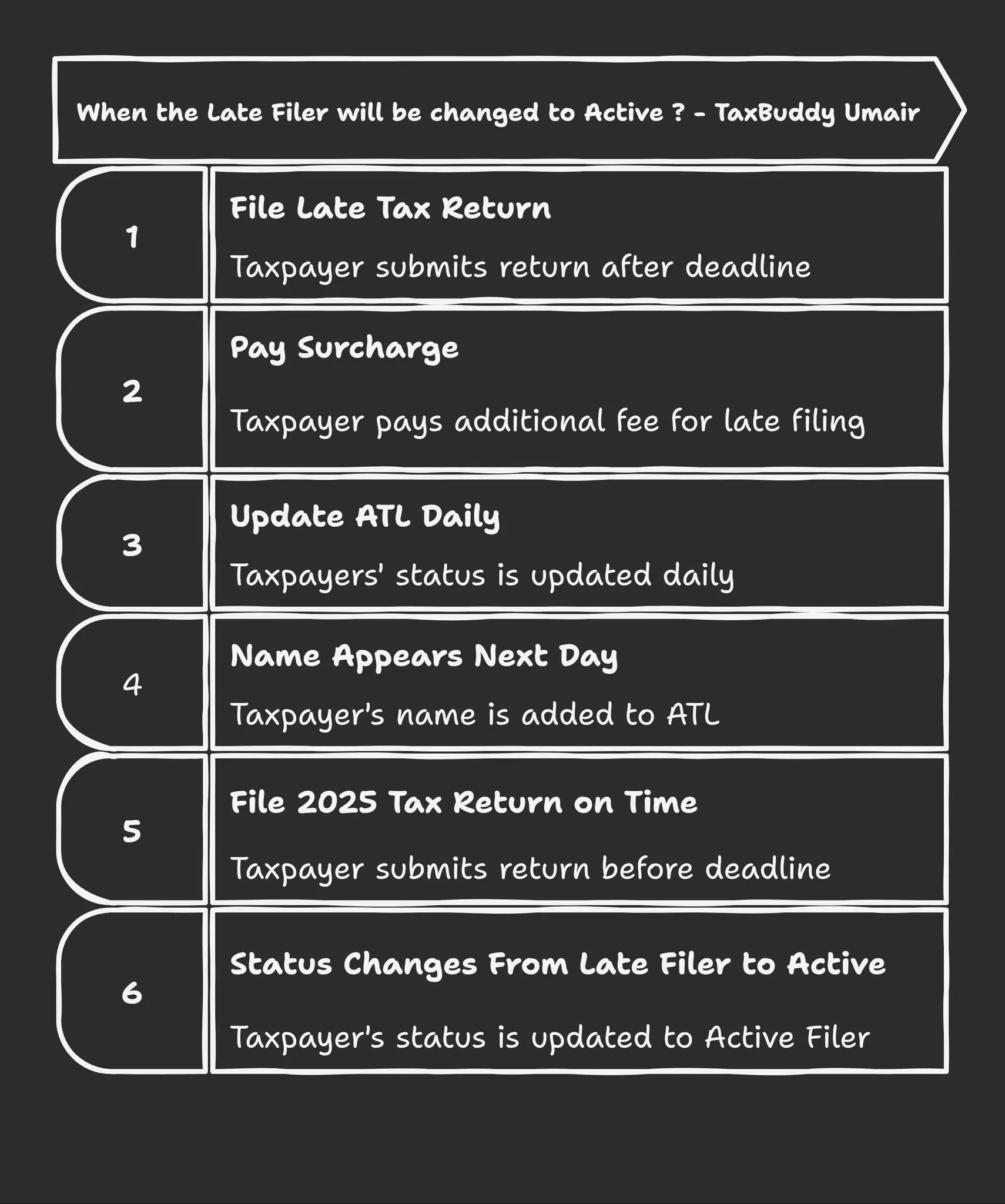

The PKR 100,000 Rule That Changes Everything. This is the most critical point that businesses often miss.

What Does the Law Say?

If a wholesaler, dealer, distributor, or retailer: Pays advance tax under Section 236G or Section 236H during the last twelve months and the total amount exceeds PKR 100,000

That business is deemed a Tier-1 Retailer under Section 2(43A) of the Sales Tax Act, 1990. This happens automatically. No separate notification, application, or consent is required.

What Does Deemed Tier-1 Retailer Actually Mean?

- This is where serious compliance obligations begin.

- Being a Deemed Tier-1 Retailer Means:

- You become liable to be registered under the Sales Tax Act, 1990

- Sales Tax registration becomes mandatory, not optional

- You must comply with Tier-1 Retailer requirements

- You must integrate your business with the computerized system of FBR