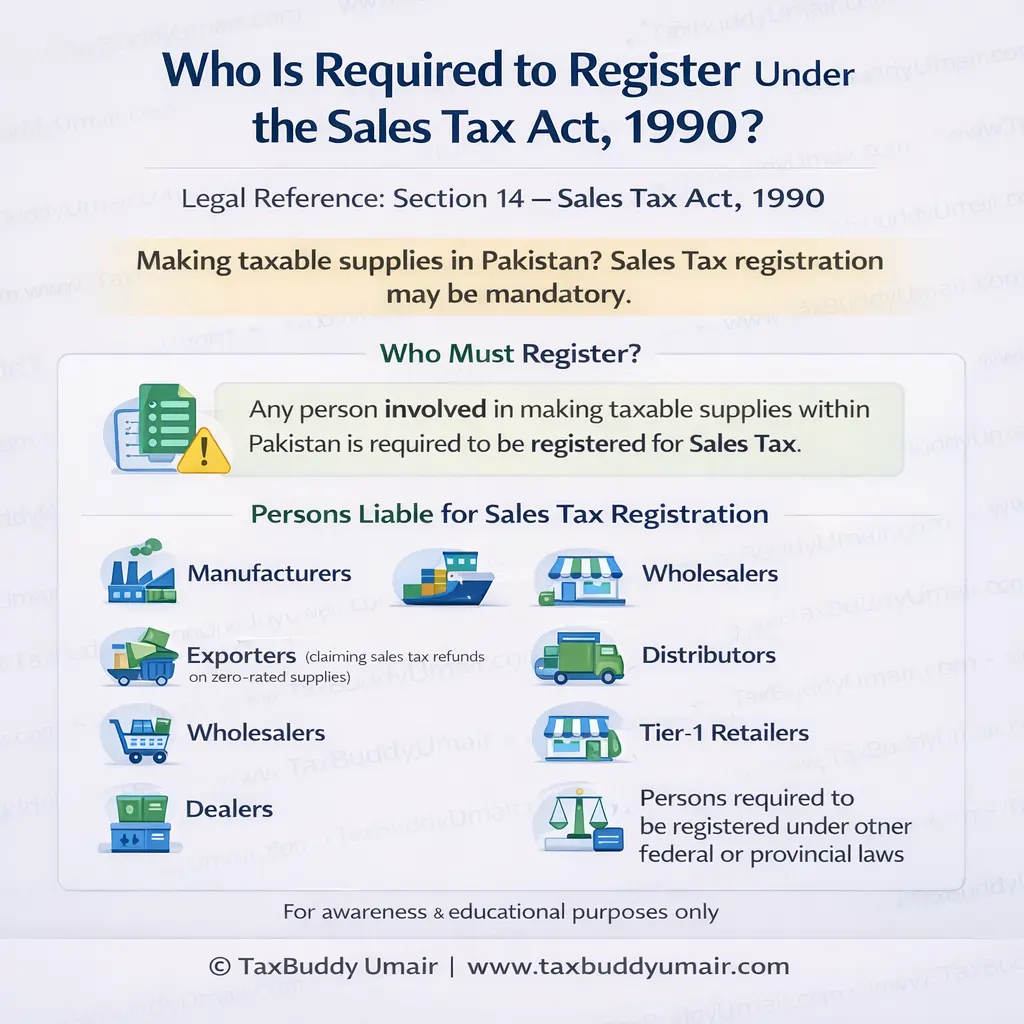

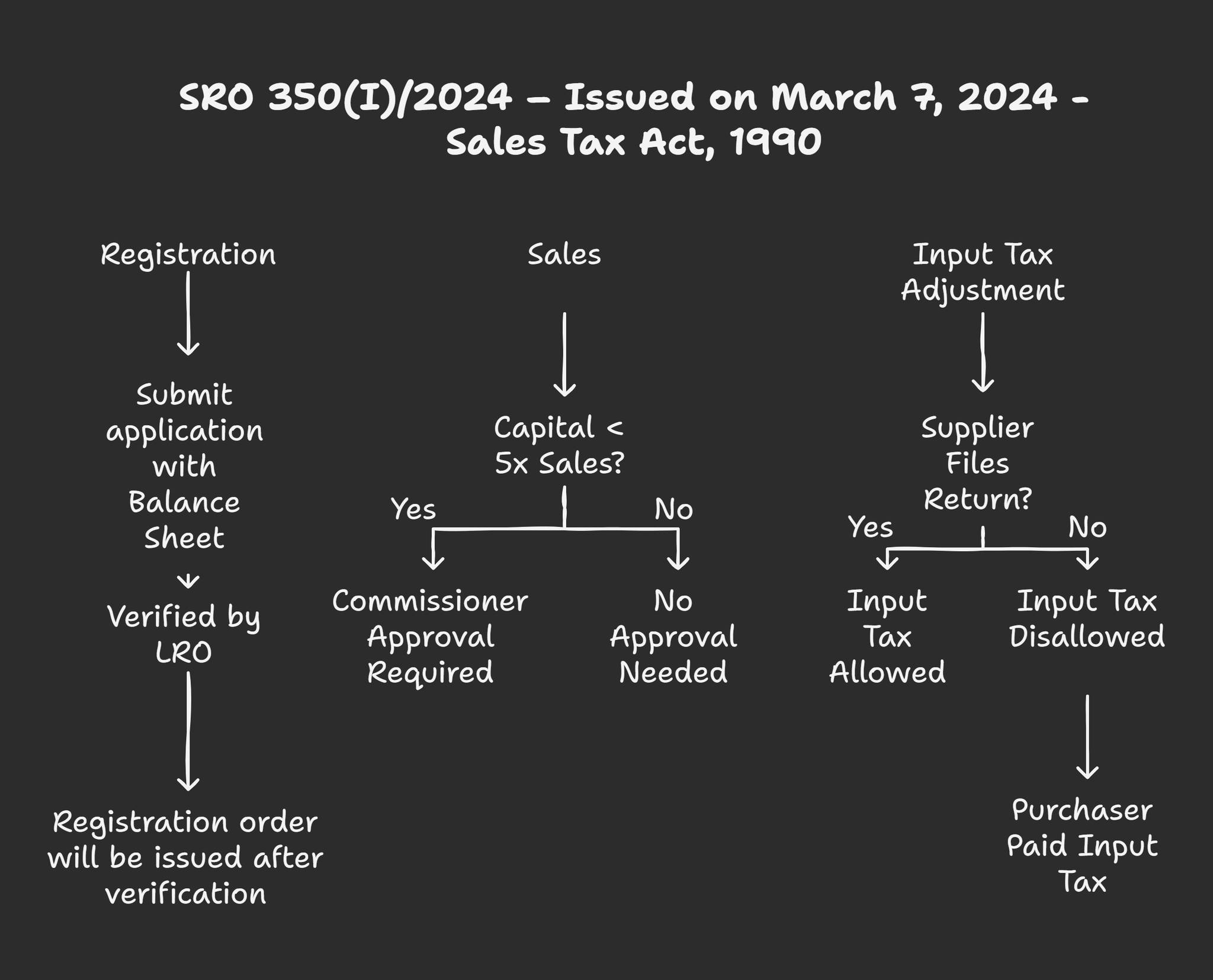

Who is not Liable to Register under Sales Tax Act 1990

Who Is Not Liable to Be Registered Under the Sales Tax Act, 1990?

Understanding registration requirements under the Sales Tax Act, 1990 is important for every business in Pakistan. Many people assume that every business man must register for sales tax, but that is not always the case.

Let’s clarify who is not required to register.

Who Is Not Required to Register?

A person who is entirely engaged in the purchase and sale of exempted supplies listed in the Sixth Schedule of the Sales Tax Act, 1990 is not liable to be registered under the Sales Tax Act, 1990.

This means:

- If all your business transactions involve exempt goods only

- And those goods are mentioned in the Sixth Schedule

Then you are not legally required to obtain sales tax registration

However, the condition is important — your business must deal only in exempt supplies.

What Are Exempted Supplies?

- Exempted supplies refer to:

- Taxable Goods on which no sales tax is charged

- Taxable Goods on which no further tax applies

- Imports of goods that are exempt from sales tax

- Supplies that remain exempt even if the supplier is registered

In simple words, these are goods legally declared tax-free under the law.

How to Identify Whether an Item Is Exempted?

To determine whether an item is exempt:

- Review the Schedules attached to the Sales Tax Act, 1990.

- Specifically check the Sixth Schedule, which lists all exempt items.

- If your product appears in the Sixth Schedule, it qualifies as an exempt supply.

It is always recommended to verify the exact description and conditions mentioned in the Schedule.

Can a Person Dealing in Exempt Supplies Claim Input Tax? No.

If a person deals only in exempt supplies, they cannot:

- Claim input tax

- Adjust sales tax paid on purchases

- Claim any refund related to exempt supplies

Why? Because:

- No sales tax is charged on their sales

- Since no output tax is collected, there is nothing to adjust

- The law does not allow input tax adjustment or refund against exempt supplies

This is a very important compliance point that many businesses misunderstand.

Important Compliance Reminder : If your business deals partly in taxable goods and partly in exempt goods, the rules may change. In such cases, proper tax calculation and partial input adjustment rules may apply. Therefore, always review your business activity carefully before deciding on registration.

Conclusion : A person exclusively dealing in exempt supplies listed in the Sixth Schedule of the Sales Tax Act, 1990 is not required to register for sales tax.